Today, I want to introduce you to the Bitcoin Difficulty Ribbon. Similar to other metrics like Reserved Risk and Thermocap Ratio, the Bitcoin Difficulty Ribbon is another reliable metric.

What is the Bitcoin Difficulty Ribbon?

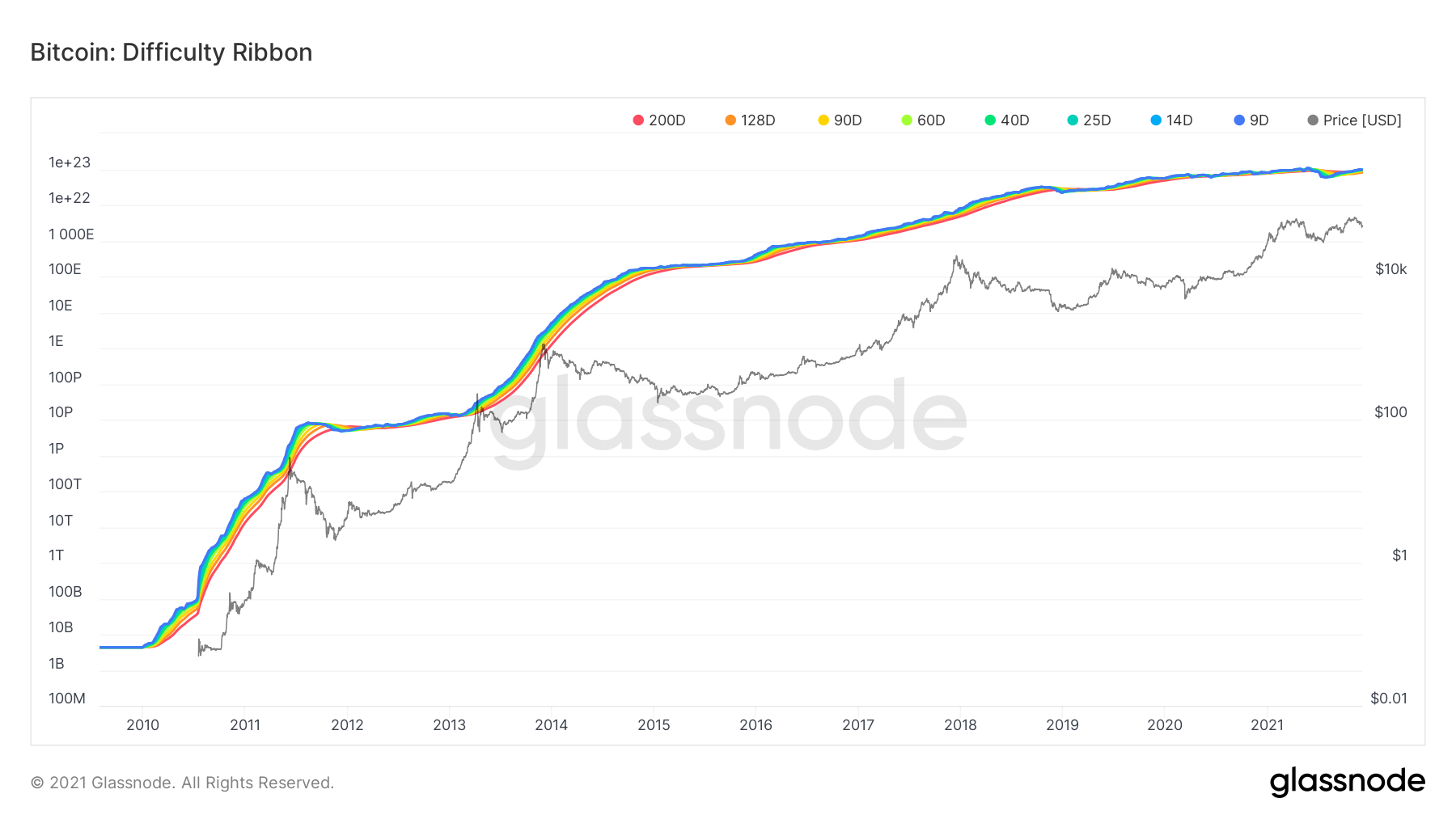

Glassnode defines the Bitcoin Difficulty Ribbon as, “The Difficulty Ribbon is an indicator that uses simple moving averages (200d, 128d, 90d, 60d, 40d, 25d, 14d) of the Bitcoin mining difficulty to create the ribbon. Historically, periods when the ribbon compresses have been good buying opportunities. The Difficulty Ribbon was created by Willy Woo.”

As we have spoken about previously, the Bitcoin network is secured by miners. Miners earn Bitcoin for being a miner. As more miners enter the Bitcoin network it creates more competition and therefore Bitcoin mining difficulty rises. The 8 moving averages (the colourful lines) in the indicator track the mining difficulty level over 9 days to 200 days.

Miners use the Bitcoin they earn to pay for production costs. As competition rises, less efficient miners have to sell more Bitcoin to remain in business. This creates a lot of sell pressure on the Bitcoin price. Eventually, the least efficient miners have to turn off their machines because it becomes too costly for them to keep running. This causes the mining difficulty level to drop. The more efficient miners, who didn’t have to sell as much Bitcoin before, have to sell even less now to stay operational. Therefore, sell pressure is reduced considerably and bullish price action can begin.

In the chart above, every time the moving averages compress together is a period when mining difficulty reduces. After each compression, an uptrend in price begins.

Two things to consider:

- The difficulty ribbon is extremely evident during Bitcoin halvings, when the mining reward is cut in half. Many miners are forced to shut off until price catches up since production costs haven’t changed. This causes more extreme difficulty adjustments and contributes to price uptrend after Bitcoin halvings.

- The ribbon can flip negative when mining difficulty drops significantly. This happened in 2012 before an epic price uptrend and again in 2019.

Here is a look at it over the last year.

Bulls on Crypto Street is a trading education website dedicated to digital assets such as Bitcoin, Ethereum, DeFi, NFTs, and other new advancements in the Metaverse.