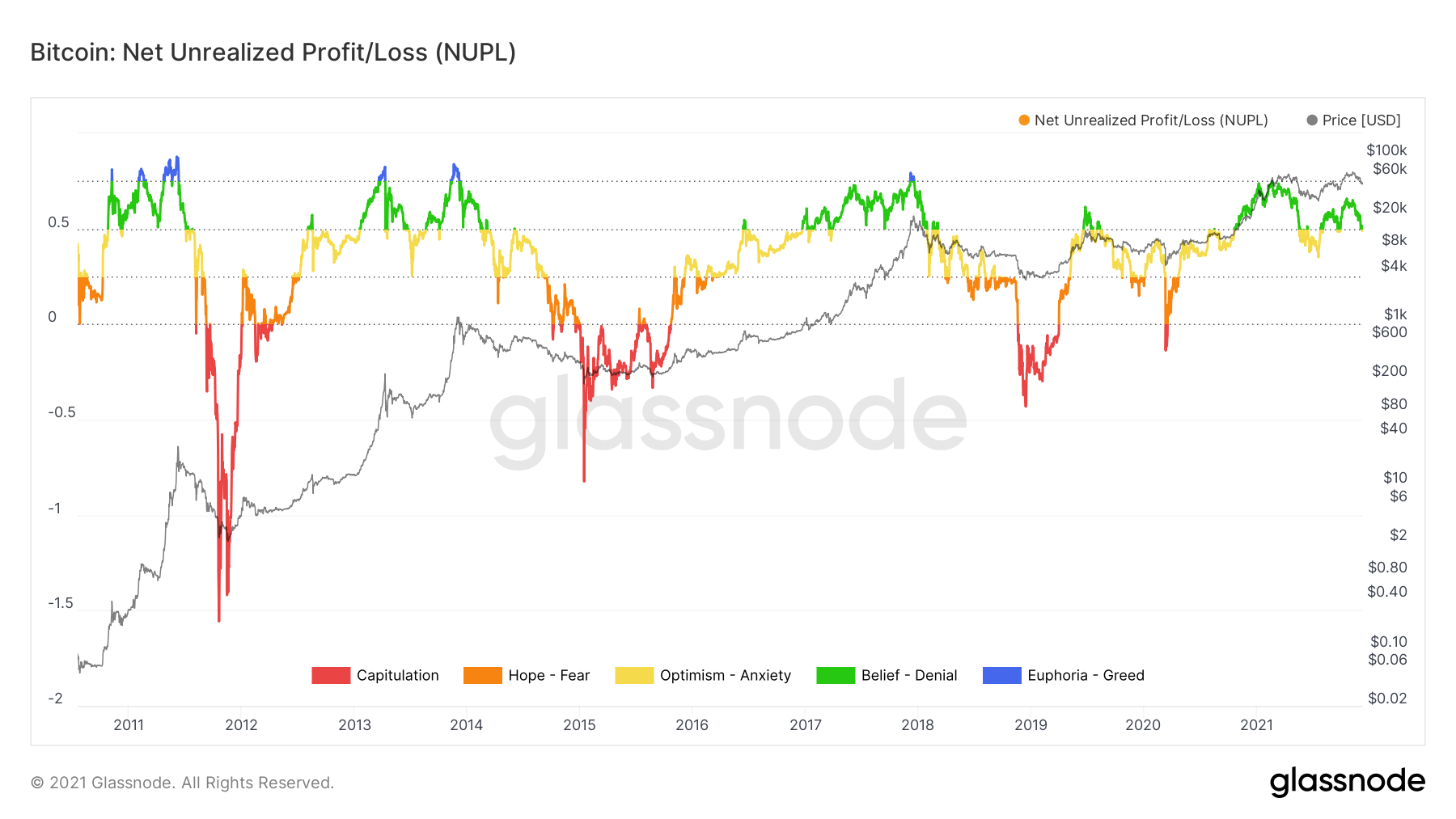

A big discussion on Crypto Twitter lately has be whether this is the market top or not. A good metric to help examine crypto market cycles is Net Unrealized Profit/Loss (NUPL). Glassnode defines NUPL as, “Net Unrealized Profit/Loss is the difference between Relative Unrealized Profit and Relative Unrealized Loss. This metric can also be calculated by subtracting realized cap from market cap, and dividing the result by the market cap.”

To break this down, we must go back to UTXO’s and realized cap. Bitcoin that is in unrealized profit is worth more currently than it was when it was last moved. Bitcoin that is in unrealized loss is worth less currently than it was when it was last moved. By adding up the total amount of the profit and loss of each Bitcoin and dividing each by market cap we get the relative unrealized profit and relative unrealized loss. The difference between the two is the net unrealized profit/loss.

It can also be calculated using market cap minus realized cap divided by market cap.

How does this information help us find market tops?

Using net unrealized profit/loss we can analyze investor sentiment at the current time in Bitcoins market cycle.

When the net unrealized profit/less gets above 0.75 it signals a Euphoria – Greed stage in the market cycle and has predicted a market top every time highlighted by the light blue colour. The reason for this is that price is rising and increasing market cap while investors aren’t taking profits. This creates a massive euphoric sentiment in the market until investors finally start to take profits.

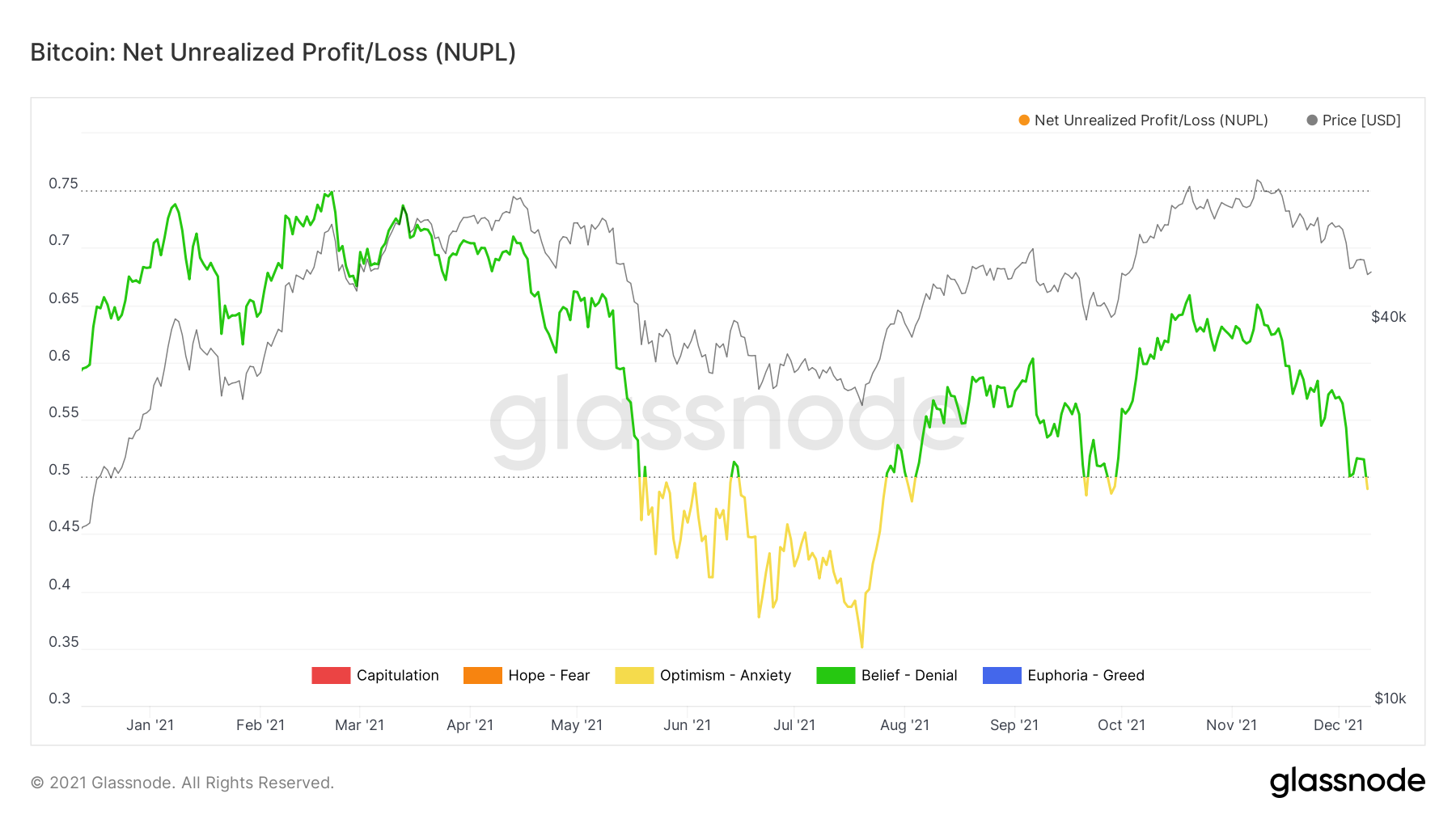

Currently, we’re in the Belief – Denial phase. Looking back into 2017, Bitcoin hit this phase at $5622 and increased to $20,000. During that period we saw many up and down moves within the Belief – Denial phase, similar to what we’re seeing now. Playing a bounce off the 0.5 area has been a good buy in bull markets. We have yet to hit the Euphoria area this market cycle so by this metric the market top has not been reached. However, there is always the looming scenario that this time is different and these metrics used for prior cycles are no longer relevant in a crypto market with many new bigger players and different macro elements at play.

It’s important to remember we don’t use one metric to make educated predictions. We use many to give ourselves the best odds at making the right call. In the end, nobody knows what will happen.

Here is a closer look at 2021:

Bulls on Crypto Street is a trading education website dedicated to digital assets such as Bitcoin, Ethereum, DeFi, NFTs, and other new advancements in the Metaverse.