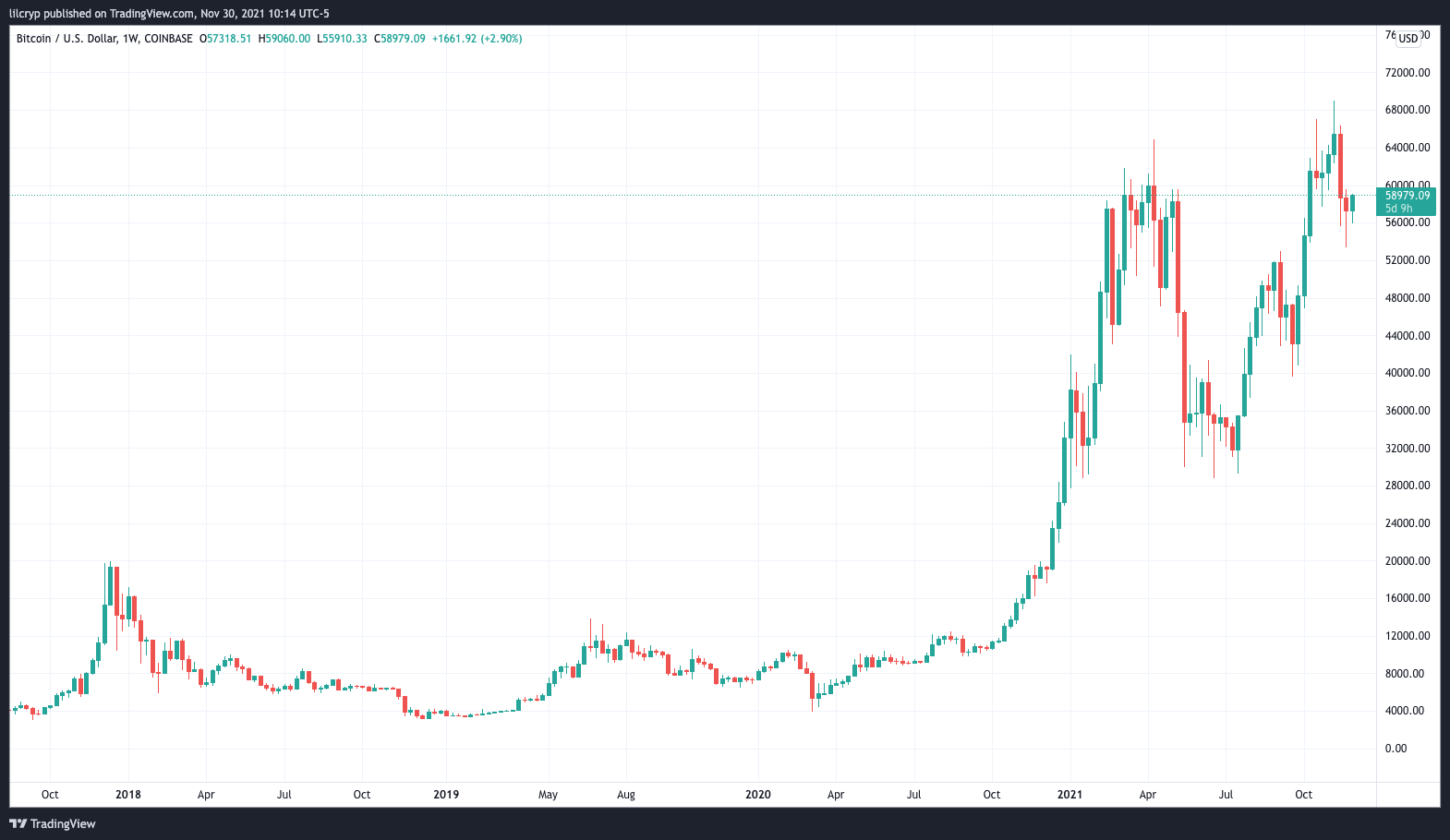

If you’re a Bitcoin holder it’s time to celebrate! BTC is worth close to $60,000. Congratulations if you held since its last ATH in 2018. It has been a crazy ride.

One company that comes to mind during this time is MicroStrategy, who put $3.57 billion of their treasury into Bitcoin. Michael Saylor, the CEO of MicroStrategy has become a huge trailblazer for Bitcoin the past year. The decision to put so much of their treasury into Bitcoin as a public company takes massive courage and unbreakable belief. However, since Mr. Saylor made the decision, MicroStrategy has doubled their USD value in Bitcoin as the price has been trending to all time highs. Their current average price is $29,534 per Bitcoin and they hold 121,044.

MicroStrategy has purchased an additional 7,002 bitcoins for ~$414.4 million in cash at an average price of ~$59,187 per #bitcoin. As of 11/29/21 we #hodl ~121,044 bitcoins acquired for ~$3.57 billion at an average price of ~$29,534 per bitcoin. $MSTRhttps://t.co/OA8VWG1bZX

— Michael Saylor?? (@saylor) November 29, 2021

Why did MicroStrategy do this?

It all comes down to narrative. The narrative of Bitcoin over the passed couple years has formed into a store of value. We spoke about this in previous newsletters because it is the major idea driving Bitcoins value in the market. As the FED keeps printing more stimulus money, the fiat in a companies treasury becomes less valuable. Since Bitcoin has a limited supply of 21 million without the ability to create more, an increase in demand significantly drives up its value.

MicroStrategy isn’t the only one.

MicroStrategy isn’t the only company doing this. In fact there is a whole website dedicated to tracking Bitcoin Treasuries. Check it out here.

Currently over $87 billion has been invested into Bitcoin by company treasuries. This includes private companies, public companies, countries, and ETFs. This equals to 7.118% of the Bitcoin supply.

One stand out company is Grayscale who owns over 650k Bitcoin. They operate the ticker $GBTC that retail investors can buy on the stock market. It flows with Bitcoin with a small premium.

Here is the complete chart by category from Bitcoin Treasuries.

Every single company in this list has made profit on their Bitcoin holdings versus continuously losing wealth holding fiat. The market now has a legitimate option against government controlled currencies and inflation.

Bulls on Crypto Street is a trading education website dedicated to digital assets such as Bitcoin, Ethereum, DeFi, NFTs, and other new advancements in the Metaverse.