Despite the continuous downtrend of the cryptocurrency markets this year, there are still plenty of opportunities to make money to the long side. But they have to be quick trades, usually day trades or short-term swings. On the 19th, the altcoin QTUM was just added as a USDT pairing to Binance, which caused it to get a nice pop. Once we saw it show some signs of strength and holding up, it got our interest and put us on watch for a quick trade. Here is our entry and exits we took in QTMUSD last week:

All The Ingredients For The Perfect Storm

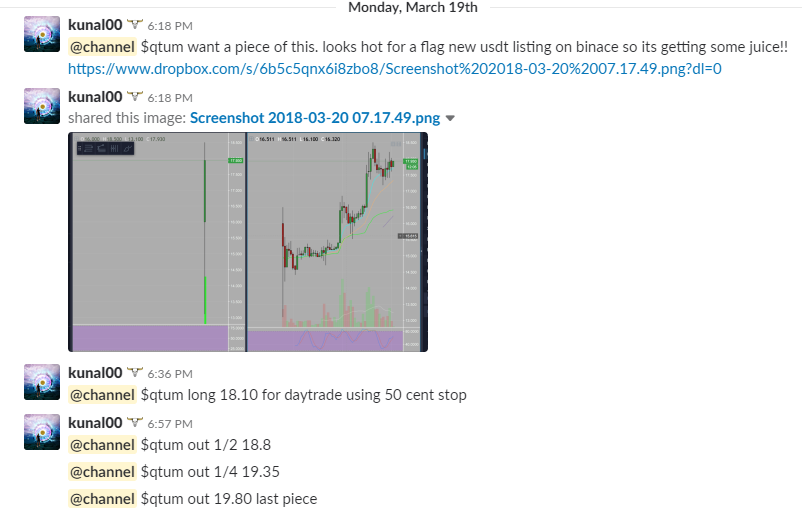

We can see that intraday QTUM was on a nice intraday trend. It had already demonstrated its ability to trend with the 9 EMA and it had been holding up in the higher part of its range. Its’ addition to Binance also meant the possibility of even more buyers entering the name in the near term. Bitcoin was also bouncing at the time as well, which is something you always want to see when you are looking to long an altcoin. One you combined these factors with an intraday flag pattern and an oversold daily chart that was showing signs of a trend change, you have all the ingredients for some great momentum. Here is some more of my commentary and how I scaled out of my position:

Cannot Marry Your Long’s In This Environment

Due to the weakness of the overall market, these type of trades are ones that you cannot marry. You can see on its daily chart that it is still in a downtrend with many resistance levels above:

You can see how oversold it was at the time of our entry. We also saw a nice hammer candle the day before our entry, indicating that the altcoin was ready for a bounce. It is crucial that you wait for some confirmation that an altcoin is ready to bounce rather than trying catch a falling knife and guess where the bottom is. This year’s cryptocurrency market has been unforgiving to dip buyers.

Take Your Profits Quick: No Lotto Shares

Longing cryptocurrencies this year is very different from last year. Last year you would always leave a portion of your shares for the bigger move to the long side. However, this year that is a strategy that you want to avoid. Altcoins (and Bitcoin), after they bounce, tend to fade off quick, so if you don’t take your profits quick your trade might quickly turn into breakeven or a loss.

We did sell a bit early, as it ended up running to almost $22. In this years market, it is better to play it safe and take a decent gain to the long side when you have it. It is difficult to not take profits when you have a 10% gain in under an hour, especially in cryptos where big moves tend to happen over longer periods of time. Don’t try to pick tops and bottoms. Try to capture the meat of the move, especially when you are going counter trend to the overall market conditions. You can also see how it faded off in the days after, demonstrating why you want to take your profits quickly.

Get Alerts To the Best Altcoin Trading Setups

Our cryptocurrency chatroom is the #1 place for cryptocurrency traders. Our community has active cryptocurrency traders of all skill levels. We are alerting each other 24/7 to potential setups to the long and short side. We rarely miss a big move because we have so many eyes on the cryptocurrency markets at all times. Learn more about Cryptostreet here.

Kunal Desai is an American day trader (stocks and cryptos) and founder of Bulls on Wall Street and Bulls on Crypto Street, two online trading academies and informational publications. He has been featured in many high profile publications like Inc, Forbes, Buzzfeed, and Fortune. He has spoke at trading and business events all across the World.