Everyone is talking about it, but what are people doing about it? The Bear Market…*insert spooky music*. Crypto is crashing, NFTs are still useless and everyone is getting hacked. Fortunately, we see things from a different scope. Contrary to the panic, now is the pristine time to be looking for these Web3 opportunities. Why? I’m so glad you asked.

Companies are busier than ever and recently team members from Rapid Innovation went to the NFT EXPOVERSE in none other than Los Angeles, California, and had the opportunity to see some of the brightest and most innovative ways people are transforming not just the Blockchain/Crypto space, but yes, NFTs.

NFTs are gaining traction in areas like:

- Tokenization of Intellectual Property rights with NFTs

- Supply chain management

- Finance

- Insurance

- Real estate

- Music Industry

- Visual art

- SaaS

- Healthcare

- And yes you can even mint your DNA

Remember NFTs are just programmable tokens, but have applications and the potential to unlock immense value-Beyond Art. They enable decentralized markets for all assets on the planet and eliminate barriers restricting liquidity and interoperability across different assets like physical property. They eliminate the middleman, and perhaps best of all, using NFTs is seamless and straightforward–it’s a technology that anyone familiar with crypto will be able to understand without extensive onboarding from an expert.

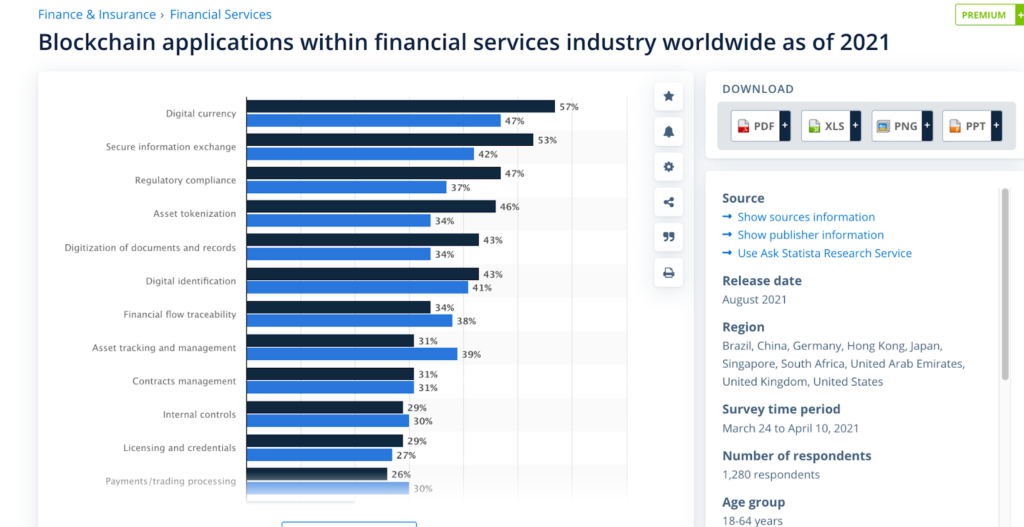

We can classify NFT use cases into two categories: tokenization of intangible assets and representation of physical assets in the digital world. Asset tokenization was the 4th most popular blockchain application in the financial services industry in 2021 (Statista).

An NFT can represent ownership of any physical or digital asset. For example, Unstoppable Domains sell blockchain domains, and when you buy one, you receive it as an NFT. You won’t have to pay renewal fees and the domain remains your’s forever. Wouldn’t that be nice?

Other examples?

Tokenization of Intellectual Property rights with NFTs

Patents, licenses, and intellectual property assets are among the most valuable illiquid, transferable assets. Transferring and using intellectual property in financing agreements became vital for growth and investment. Blockchain and NFTs enable smooth asset exchange by creating efficient mechanisms for the open and secure transfer of property rights. With NFTs, we can now trade and leverage IP assets on the blockchain.

Today, leading technology companies, including IPwe, offer patent tokenization and partner with tech giants like IBM to tokenize intellectual property assets. IBM and IPwe are creating an infrastructure for a marketplace where people will sell and buy patents using NFTs. Moreover, this marketplace will be ideal for establishing licensing agreements, building and assessing patent portfolios, etc.

Without blockchain, any transaction involving IP is lengthy and costly, involving lawyers, attorneys, and a lot of paperwork.

With NFTs, we can distinguish ownership of an IP with timestamps, showing the entire history of the IP transactions.

Blockchain and NFTs offer efficient and cost-effective ways to create a transparent, auditable, and resilient environment where patent owners can benefit from tamperproof, decentralized networks to trade and exchange IP rights worldwide.

NFTs for supply chain management

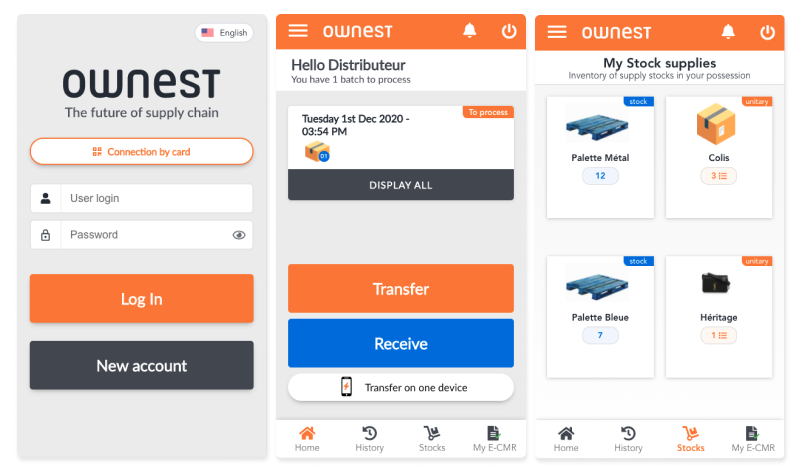

One of the biggest challenges in supply chain management is verifying product authenticity. A brand’s name is an asset with a specific value for consumers and enterprises. Together with projects like ownest.io, Blockchain technology represents physical goods, like branded clothes, accessories, and much more. In the digital world, ownest.io uses NFTs to determine the ownership of products and who is responsible for this item at a given time. The owner of the NFT or the digital twin of the product is responsible for the physical object. Use cases for NFTs in supply chain management are almost limitless, and here are some highlights:

- Tracking heavy (+30kg) packages. Imagine an Amazon-like company that sends billions of heavy packages every year and loses a few thousand along the way, including yours. With NFTs, Amazon can create a token for each package on a pallet by just scanning each item. As a result, there will be an identified owner with a package at each stage, and no package will be lost.

- Every year companies lose thousands of dollars because of losing reusable packaging, like pallets. Think about “pallet-furniture” you see on YouTube that shouldn’t exist at all. NFTs offer easy and cost-effective tracking for reusable packaging. Now companies can create a digital twin in the form of NFT for each kind of reusable packaging, follow their movement and check the balances in real-time. If some packages get stuck (for example, five pallets that never move from their location), the owner gets notified and takes them back to the warehouse.

- In the automotive industry, you can create an NFT to represent digital identity for any part of the vehicle – from microchips to batteries or engines. This identity will include current location, ownership, temperature, responsible party, etc. This data can be automatically updated via time-stamping and geolocation and will represent accurate and complete information about the physical object to all parties involved. As a result, if one of the parts in China is delayed, the manufacturer will get notified in advance and source what is missing from other locations, like India, and the supply chain will continue working without disruptions. Not to mention being able to track any sort of recall or safety concerns along the way.

The same technology applies to the food and beverage industry or any goods for that matter. For example, NFT can represent each bottle of wine from a specific distillery with a digital twin. A Norwegian platform, wiv.io, does precisely that. They create wine NFTs that represent actual bottles of fine wine. This technology opens new opportunities not only for wine lovers but also for investors, who can trade fine wine without storing the actual bottles.

NFTs in finance

Out of all NFT use cases, the finance sector can get the most benefit from this technology by implementing quick, cost-efficient, error-free ways to verify bonds insurance, prevent fraud and manage debt. Finance is one industry that needs better tools for verifying the provenance of business contracts, so NFTs are perfect to prove ownership of an asset and confirm the existence of an insurance policy or a title record. NFTs offer proof that can’t be taken away and provide an extra level of security, especially in jurisdictions that suffer from corruption or rely on paper records.

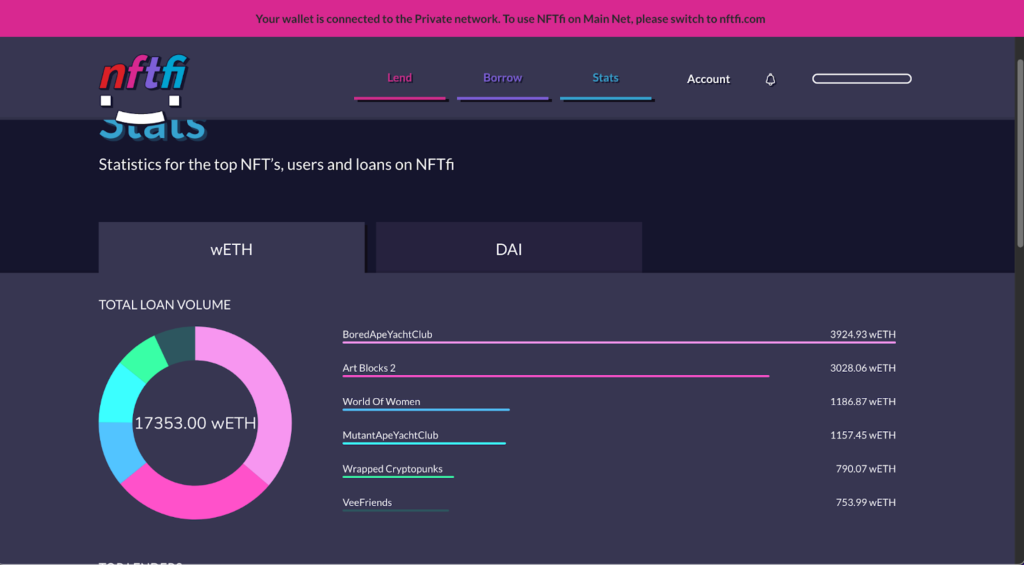

The DeFi world is actively adopting borrowing against NFTs as collateral. For example, if you own one of the CryptoPunks that can sell for as high as $1 million or more, you can borrow against it. Once you clear the loan, the CryptoPunks NFT gets released back to you. What’s more, you can fractionize your CryptoPunks for a smaller amount to avoid accumulating a bigger debt. Currently, the most popular P2P platforms for NFT collateralized loans are Stater and NFTfi.

How does P2P borrowing work?

In the marketplace model, like NFTfi, borrowers offer the app NFTs as collateral, and lenders can choose which NFT they are willing to accept before initializing a loan. The NFT that is used as collateral is then kept in an escrow contract, and if the borrower defaults on their loan by not repaying the initial amount plus interest on time, the NFT is transferred to the lender. With the development of marketplaces like NFTfi, we can forecast that we will be able to use NFTs that represent physical items (fine wine, physical art, real estate, lands, etc.) as collateral to borrow against soon.

NFTs in insurance

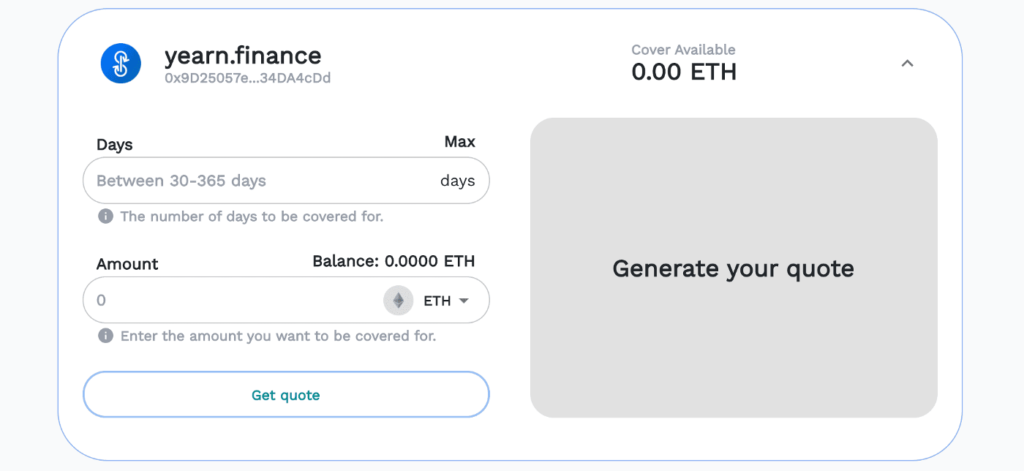

Another use case for NFTs in complex financial products is insurance. Yinsure by yearn.finance is an excellent example of NFT usage in insurance. It’s an entirely new kind of tokenized insurance, a pooled coverage underwritten by Nexus Mutual. You can insure your assets with Yinsure regardless of whether it’s a base or a composite asset. Just fill in the days and amount of crypto you need to cover and get your insurance policy instantly.

What’s more, you can transfer, buy and sell those insurance policies in the form of yNFTs on Rarible, where you can buy your coverage bypassing any DeFi protocols.

NFTs in real estate

Unlike other forms of investment, the world of real estate is actually one of the least liquid asset classes in the world. The process of buying or selling a piece of property is complicated, often requiring brokers or lawyers and involving considerable time lags between decisions and actual transactions. Moreover, the real estate sector lacks decentralization and a proper mechanism to verify each transaction automatically.

Tokenization of real estate will allow more investors to access this asset and limit nefarious activities like money laundering and tax evasion. Today, several projects, including propy.com, are working on opening up new opportunities for real estate transactions. NFTs can transform the industry and help create a self-sufficient, automated network for real estate transactions.

So how does it work? The ownership of the property is held and recorded as an LLC (while we can tokenize LLC, we can’t tokenize an actual property). The buyer of the NFT obtains the rights to the LLC, with the property owner signing legal papers for NFTs to transfer NFT ownership to all future buyers.

Benefits of real estate tokenization: The real-estate market badly needs new approaches and interventions. Attracting more people to the market, including international individual investors and everyone else who is currently prohibited from making such investments directly, would result in lower prices, more transactions, and greater overall efficiency. Here is what tokenization offers:

- More liquid market with less bureaucracy, minimal transaction costs, and almost zero market friction.

- More efficient rights management thanks to smart contracts that contain hashed data of each property, including information about repairs, previous owners, and amenities.

- Opening up global markets and adding even more liquidity by offering new opportunities for international investors to purchase real estate shares overseas, bypassing regulatory restrictions.

- New forms of funding for private home buyers. NFTs allow home buyers to raise funds for an apartment they want to buy by issuing fractional tokens and selling shares in the apartment. The token holders will be co-investors and can collect fractional rent according to the number of shares they bought.

Tokenization is the natural next step in real estate sales and financing evolution. Tokenization will make possible the sale of different fractions of ownership and mortgage loan participation. Today, we can trade digital tokens faster and more efficiently than any other financial asset. Real estate tokenization will complement the overall market by offering a flexible and convenient way to transact with otherwise illiquid assets.

NFTs in the music industry

If streaming revolutionized the music industry, NFTs could transform it by becoming the most substantial change in the music business since the emergence of streaming platforms. One of the reasons for NFTs being so transformational is that they offer an opportunity for musicians to get paid for years to come. Aside from a musician making an initial NFT sale and profiting from it, they can keep a percentage of all future NFT sales.

Visual art: For example, someone buys an asset or an artist logo for an album cycle at $10,000. The artist can then designate to keep 10% of all future sales. It means that they will get 10% every time a sale of that NFT happens. So if the fan base grows together with demand, the price of the NFT will grow too, and it might sell for $100,000 in the next cycle. Visual art, like logos, album covers, etc., constitutes the first phase of music NFTs because blockchain technology already allows it. You can find plenty of album art, t-shirt designs, concert photo prints, etc., on Open Sea and other NFT marketplaces.

Music samples: Currently, we don’t have the technology to sell full master tracks as NFTs. Therefore, similar to Illlmind, artists sell samples and rights as NFTs instead of full tracks. The next phase in developing music NFTs is to figure out how to sell master recordings of a song.

Tokens of live performances: Think of those high-production live streams everyone is doing now. With NFTs, people will be able to own videos of those streams. Artists can do the same with live shows, where you will have the opportunity to buy the video recording of this show as an NFT. We will see NFTs in every pre-order of a record, packaged with every live stream and merch bundle. VIP experiences, meet & greet will all come with NFTs of, perhaps, your selfie with an artist or some other digital assets. Brandon Zemp is an example who has already made NFTs for each corresponding podcast episode.

NFTs for event ticketing: The current problem with event ticketing is that secondary markets can take ticket prices to extremes. It happens partially because bots automatically increase prices to drive up profits through the highest possible markups. The major challenge for event organizers is limited control over transactions on secondary markets. Even unique static codes on tickets do not allow linking a ticket to its owner and do not restrict reselling it. It’s also not feasible to completely attach a ticket to a person and prohibit reselling because it will cause time-consuming and costly entry checks at the event. NFTs might solve this problem and bring transparency and trust to the ticketing market.

How? Event organizers can mint NFT tickets using any blockchain platform that supports smart contracts. Smart contracts allow us to embed logic and rules in digital assets directly, including a maximum sale price or an auction. It is very different from embedding logic in the conventional third-party applications that control assets. Attendees can then save those NFT tickets in their mobile wallets. Event organizers stay in control of the process and establish price limits and fees for ticket sellers. This hard-coded logic of smart contracts is superior to regulation that requires the implementation of rules by humans and monitoring user behavior manually.

NFTs for event ticketing can help prevent fraud, save costs for organizers and attendees. Blockchain will create a more transparent and auditable market and offer a continuous revenue stream for organizers and artists by reselling merchandise, content, etc. What’s more, event organizers can create collectible NFT tickets that attendees can then resell to other fans.

NFT tickets can also offer attendees more perks, like unlocking food and beverage discounts or some exclusive features for future events. For example, the first-ever NFT ticketing event by MetaCartel announced that their NFT tickets would unlock features for future events.

Conclusion

A ‘single source of truth’ is an expression used in the blockchain industry to refer to a particular state or set of data that everyone agrees upon. The “truth” could be the status of a specific supply chain. It could also be information related to identity. NFTs are beginning to be deployed in this industry, providing a mechanism for the secure sharing of data and seamless coordination between all parties involved in each transaction. The tokenization of everything is already happening – further adoption and integration with artificial intelligence could help avoid catastrophes like “The Great Disruption” of 2021.

Blockchain technology is a tool for disintermediation. It enables people, businesses, and organizations to interact without the need for middlemen. Blockchain has the potential to allow individuals and groups to save and transfer assets without third parties or institutions serving as intermediaries.

The revolution isn’t coming, we are already in it.

Written by Rapid Innovation

Sign up for their Newsletter: https://blog.rapidinnovation.io/

If you want to learn more about trading and investing in NFTs, check out our Crypto Trading Bootcamp.

Rapid Innovation helps businesses like yours build beautiful, user-friendly blockchain apps – no technical knowledge required. They help you go from concept to launch – with as little as an idea.