Bitcoin just had a very bearish break of support in the past 24 hours. The break of the 9000 level put just about every buyer who was looking for a return to $20k in the past month under water. Despite the strong bounce in Bitcoin and other altcoins in the past month, we have not been convinced. We have been only holding our longs for short periods of time, and are quick to cut our losses when it goes against us.

Now that Bitcoin just broke under the psychological $10k mark and now the $9000 support level, the obvious bias is now to the short side in the short term. In order to capitalize in the current market conditions, you need to know how to short Bitcoin and other altcoins. Here are some trades we took in our cryptocurrency trading chat room in the last couple weeks:

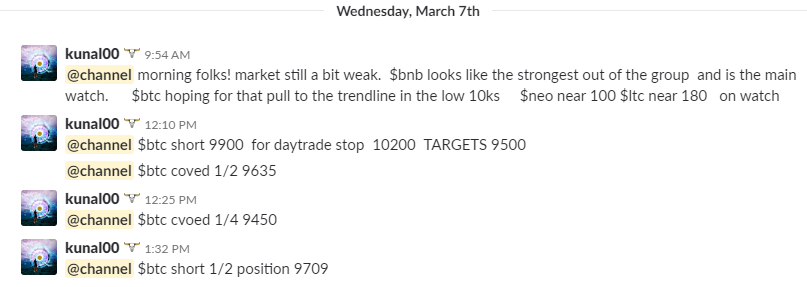

Every morning in our chatroom Kunal gives his thoughts on the current cryptocurrency market conditions. He also alerts all of his entries and exits as well. Here is a sample of his market commentary:

Note his trade alerts are NOT for you to blindly follow. They are for educational purposes so you can see what he is looking at in real time. They are more for confirmation that you are seeing a good setup. You will never become a successful, independent trader if you are dependent on other people’s alerts.

Shorting Opportunity in Altcoins As Well

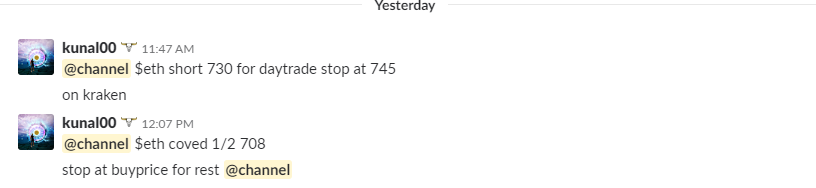

Most altcoins still follow Bitcoins general trend. This means that when Bitcoin is down-trending, most altcoins will be down-trending as well. Here is an example of a trade we took in ETH to capitalize on the altcoin weakness:

This ETH trade is a perfect example of a setup aligning on multiple time frames. Once Ethereum broke under 780 support, we have been looking for pops, and consolidation to get a good entry. You can see on the chart above that ETH gave us a textbook bear flag into the moving averages to manage our risk. You never want to be chasing weakness on volatile altcoins like Ethereum. Wait for sideways consolidation and some range contraction before entering. Unfortunately, with cryptocurrencies, it is easy to leave money on the table when day trading just because you need to sleep!

Here is another example of a recent short we took in BTC:

This was more of a scalp trade we took in BTC. The reason we took a quicker trade, in this case, is because of the extension to the downside Bitcoin had already. You can see on the chart that it had already fallen from $11k to $9.5k in around 12 hours. When we took our short position, we were not expecting Bitcoin to dump too much further than under $9k. Bitcoin moving just over 2000 points in a day is a big move for it. When a cryptocurrency starts to get extended from its intraday moving averages and starts to speed up to the up or downside, usually it reverses quick. This is why we took our profits just into the flush under $9k. It is crucial that you pay attention to a crypto’s ATR (Average true range) when you are day trading them. This will affect a lot how you set your targets and make sure that you take profits at the right spots.

Always Manage Your Risk

Not every trade is going to be a winner. In all of the examples above you can see that we had stop-loss pre-planned. You are not going to have a 100% win rate, and anything can happen in trading. Before you enter a trade, you need to know the price point where you will get out if you are wrong. When you are looking to short Bitcoin and other cryptos, you should put your stop loss over resistance levels. It is especially important to manage your risk when you are shorting because it is possible to lose more money than you put in if you are stubborn and don’t cut your losses.

Get Alerts To the Best Crypto Shorting Setups

Our cryptocurrency chatroom is the #1 place for cryptocurrency traders. Our community has almost 300 active cryptocurrency traders of all skill levels. We are alerting each other 24/7 to potential setups to the long and short side. We rarely miss a big move because we have so many eyes on the cryptocurrency markets at all times. Learn more about Cryptostreet here.

Kunal Desai is an American day trader (stocks and cryptos) and founder of Bulls on Wall Street and Bulls on Crypto Street, two online trading academies and informational publications. He has been featured in many high profile publications like Inc, Forbes, Buzzfeed, and Fortune. He has spoke at trading and business events all across the World.