In our Cryptostreet Bootcamp we discuss open interest and funding rates in detail and how to use them to swing trade the crypto market.

Future Open Interest

Bitcoin open interest is the total number of outstanding Bitcoin derivative contracts, such as options or futures that have not been settled. When it comes to futures, we can use crypto exchanges such as Kucoin which is a popular platform for futures traders. However, those are more focused on retail traders. If we want to get an idea of institutional interest we can use the CME Futures which offer Bitcoin contracts. Institutions use CME because it’s a trusted broker where large sums of money can be put to work. In addition, they don’t have to take on the risk of storing their Bitcoin while trading CME Futures. Last, it’s highly regulated in the US, giving it the credibility needed to attract institutions.

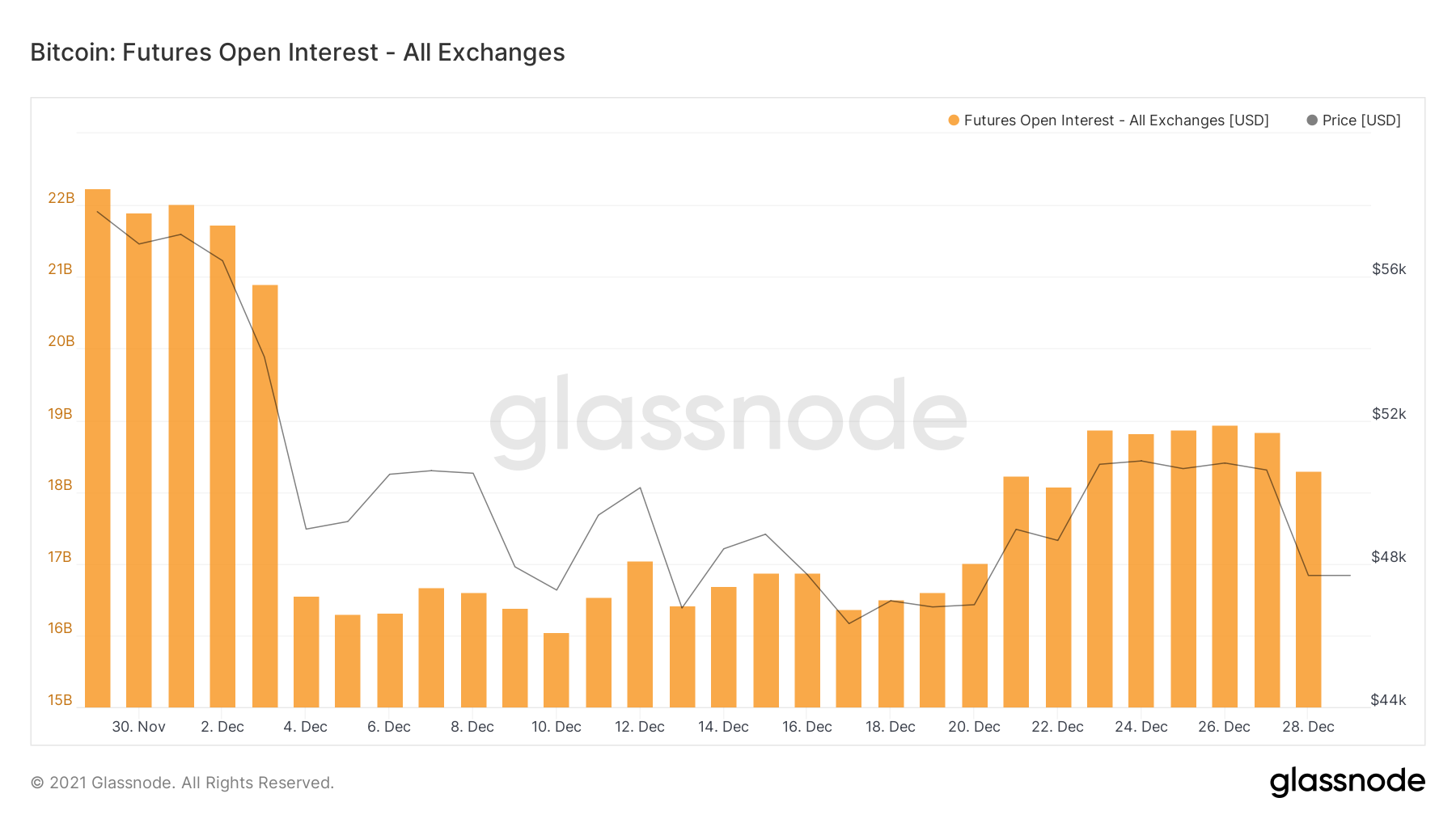

Using Glassnode, we can see the total open interest in Bitcoin futures.

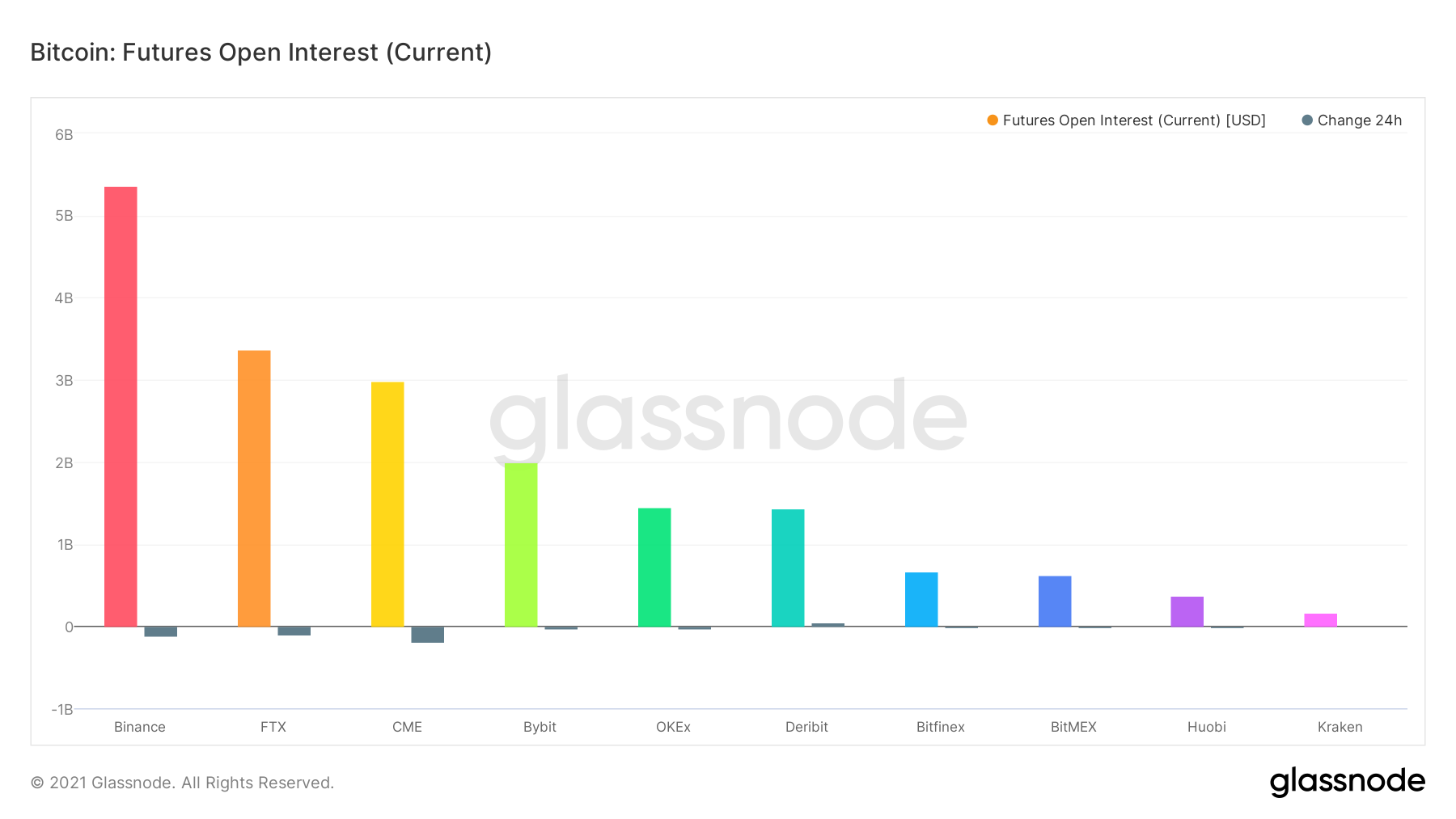

We can also see it per exchange.

These are important metrics to follow to see how much interest is building in the futures derivatives market for Bitcoin and see trader sentiment for the future price.

Options Open Interest

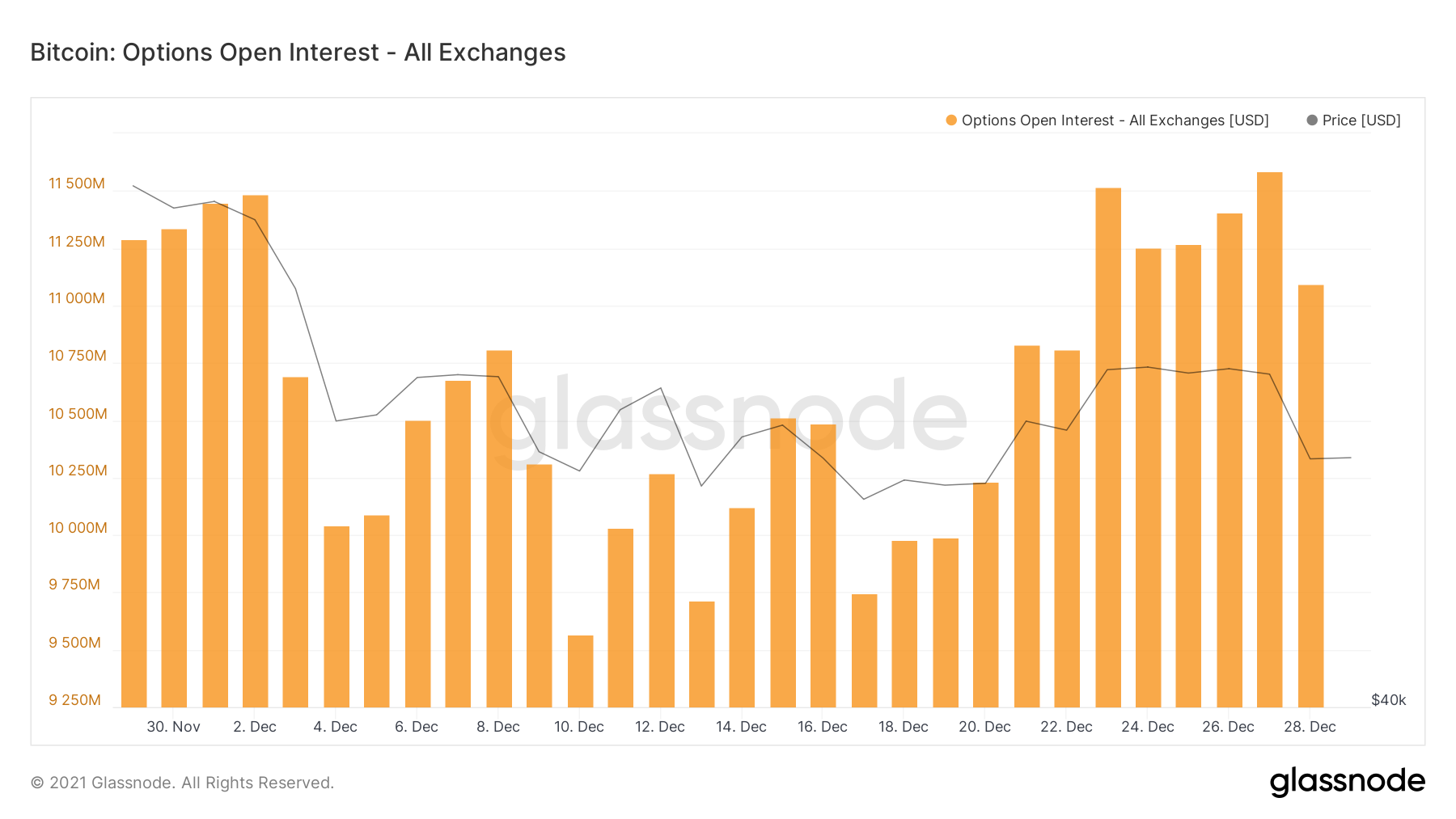

In addition to futures, we also track the Options open interest which adds up the value of the outstanding, un-exercised options. One of the most popular options brokers in crypto is Deribit. A common strategy with options is to hedge current spot positions, especially to protect gains if you have rode the uptrend of Bitcoin.

The Bitcoin options market is useful for miners that want to get an advance on Bitcoin they expect to mine, by selling call options. Since miners usually have a good idea of how many Bitcoin they will mine based on the hashrate and their equipment, call options give them the obligation to deliver Bitcoin on a specific date and price. Since they’re making that promise on the date they enter the call option, that is when they get paid. There could be many reasons why a miner would want to do this but mainly it comes down to operating at peak efficiency.

All in all, the options market creates more stability for miners and investors to hedge their positions. This could in turn decrease volatility and allow miners to more effectively run their businesses.

Here is a chart on Bitcoin Options Open Interest.

The Bitcoin market is getting more and more sophisticated as new markets open up. All of this creates a stronger foundation for the Bitcoin market to grow and thrive and put to bed all the FUD no-coiners like to voice.

Funding Rates

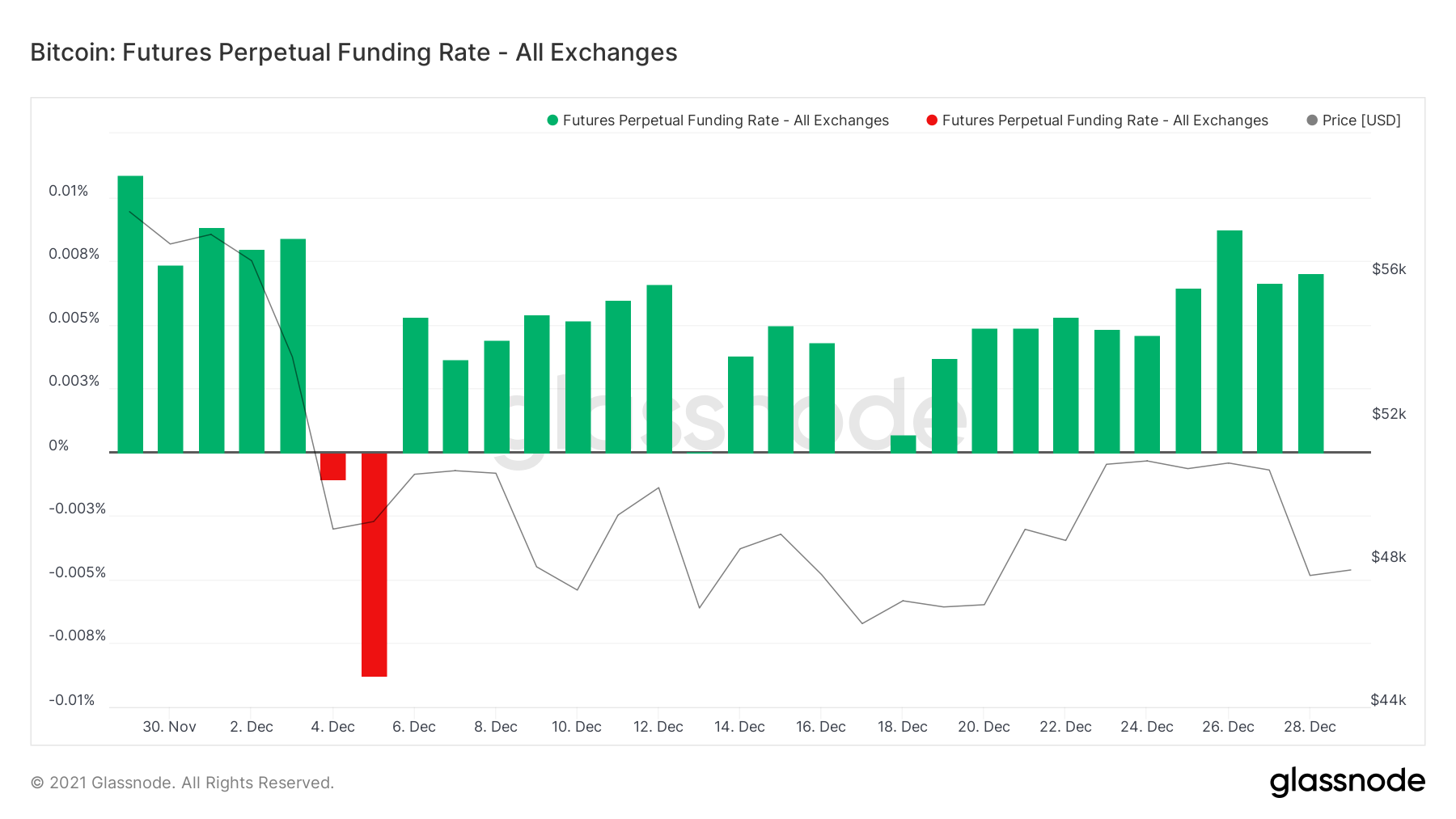

Funding rates are set by exchanges for perpetual swap contracts. When the rate is positive, long positions periodically pay short positions. Conversely, when the rate is negative, short positions periodically pay long positions. The mean Funding Rate across exchanges is an average of each exchange’s Funding Rate weighted by the Open Interest of the corresponding exchange.

As funding rates rise it shows us traders are heavily long, signalling an over leveraged market. Vice versa when the funding rate decreases and goes negative, the market is signalling an oversold market. If the price goes in the opposite direction to the funding rate it can create a series of liquidations that causes the price to make an extremely volatile move until it settles at a particular price that acts as support. This aligns with what happens during large crypto market corrections.

As you can, rates went negative during the last big correction as long got flushed out. Rates have been slowly climbing since then.

The idea is to use these metrics to see if the crypto market is over leveraged or under leveraged to make swing trading around the volatility easier.

Bulls on Crypto Street is a trading education website dedicated to digital assets such as Bitcoin, Ethereum, DeFi, NFTs, and other new advancements in the Metaverse.