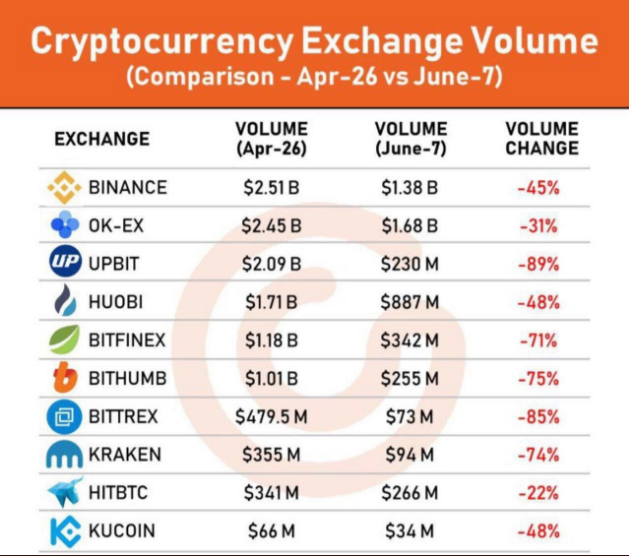

Range bound cryptocurrency trading is one of the toughest markets for new traders. The Bitcoin chart above is a good example of a range bound cryptocurrency. Even though there isn’t much range to lose a lot of money on, it is very easy to get chopped up. Commissions can rack up, and taking a bunch of small losses in a row can turn into a big red day. The current market environment has seen a big decline in trading volume recently:

Volume has declined a ton on all the major exchanges. Big money is on the sidelines because there is no obvious trend. People are waiting for the market to pick a direction before putting any size on. Here are some tips on how to trade cryptocurrencies in a range bound environment:

Wait For Confirmation Of A Trend

The general room of thumb for a range-bound market environment is to wait for a trend to form, vs trying to anticipate a direction. There will be little breaks of the range and then quick reversals. In order to avoid getting chopped, just WAIT for the range to break and hold a trend for a sustained period of time.

You can also trade cryptocurrencies while they are stuck in a range. However, you have to be shorting at resistance and buying at support. It is tempting to try to buy in anticipation of the resistance breaking, or shorting when the support is breaking. These will often be false breaks, and actually, the spots where you want to be covering or selling, until an obvious trend has formed outside of the range.

BTC has been stuck in a 300 point range for all of June. No one knows which way it will break, and when it will do it. It is much easier to join a trend when the market is trading like this vs trying to guess when it is stuck in a range. Only a few cryptocurrencies have been been giving any kind of range to make trades off of this month. EOS and Binance Coin have been the main altcoins of focus the past couple weeks.

Cash Is Also A Position

It is tough sitting on the sidelines because you want to be making money. But you have to remember that your PNL and the end of the week/month/year is made up of the combined results of your wins AND your losses. If you try to day trade in range bound markets like the one we are in now you will suffer the death of a thousand cuts, and commissions will eat you alive. You cannot control when opportunities will present themselves in the cryptocurrency markets. To trade cryptocurrencies for a career, you must have the discipline to stay on the sidelines when there is no edge to your strategy in the markets.

Now that we recently had a break to the downside out of the BTC range with some volume, we should have some volatility coming back into the markets. There will be a lot of short selling opportunities in the upcoming days. It is crucial that you preserve your mental capital so that you are ready to capitalize when the cryptos finally break out of the ranges like they did yesterady.

Use The Time To Refine Your Strategy

When markets are trading sideways, use the time when you are not making any trades to refine your trading strategy. Study your trades and ask yourself these questions: What setups have been working this year for you? What setups have been failing? What coins have you been trading the most successfully?

Refining your strategy is the best thing you can do in range-bound markets. Once the markets break out of the range, you will be even more prepared to capitalize on the new opportunity. Trading in this market environment will only make the exchange richer, not you.

New to the cryptocurrency world and want to learn how to trade cryptocurrencies? Start here.

Kunal Desai is an American day trader (stocks and cryptos) and founder of Bulls on Wall Street and Bulls on Crypto Street, two online trading academies and informational publications. He has been featured in many high profile publications like Inc, Forbes, Buzzfeed, and Fortune. He has spoke at trading and business events all across the World.