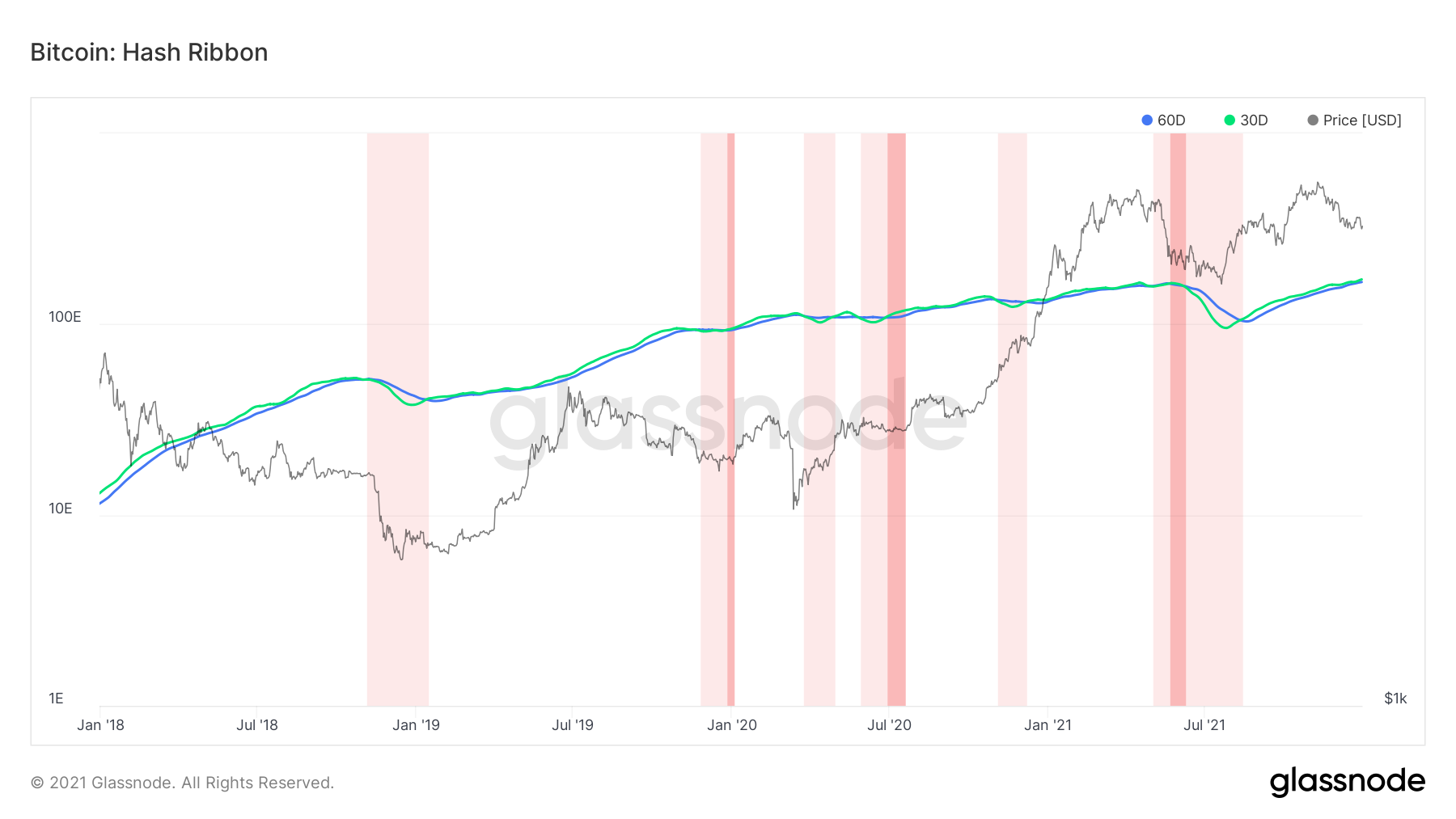

Bitcoin Hash Ribbon: Miner Capitulation & Recovery

In this short article we will be discussing the Bitcoin Hash Ribbon. This metric is specifically good at identifying great buying opportunities after large drawdowns in the Bitcoin price. It tracks miner capitulation as mining becomes unprofitable overall. Hash Ribbon uses a 30 day and 60 day moving average for the Bitcoin hash rate. When … Read more