Todays metric I learned from one of the OG’s of crypto, Willy Woo. It’s another great indicator of where we currently are in the market cycle.

In previous articles we spoke about inflows and outflows of Bitcoin onto exchanges. When a holder moves Bitcoin onto an exchange or moves it off an exchange into cold storage that gives us an idea of their intent with that Bitcoin. Moving it off an exchange is an action that signals they want to hold it and moving it onto an exchange is an action that signals they may want to sell.

Follow me so far? Great!

Analyzing the actual amount of Bitcoin on exchanges can be looked at in different ways when determining where we are in the market cycle. When large Bitcoin whales and institutions buy Bitcoin, they tend to move them off an exchange and into cold storage. They’re more crypto sophisticated investors and understand the importance of cold storage to protect their large holdings.

However, retail investors and short-term traders tend to be less sophisticated or more active and keep their Bitcoin holdings on the exchange they bought them. Also, large whales and institutions tend to be the first buyers of the market cycle while retail and momentum traders tend to come in after, while the hype of Bitcoin starts to boom.

That creates two distinct phases of a Bitcoin market cycle; the accumulation phase when large whales and institutions accumulate Bitcoin in anticipation of the next uptrend and the main phase when retail investors and traders start to buy Bitcoin.

Still with me? Awesome!

So, we know that whales and institutions buy first and move their holdings off of exchanges. Also, we know that retail buy after and keep their Bitcoin on exchanges.

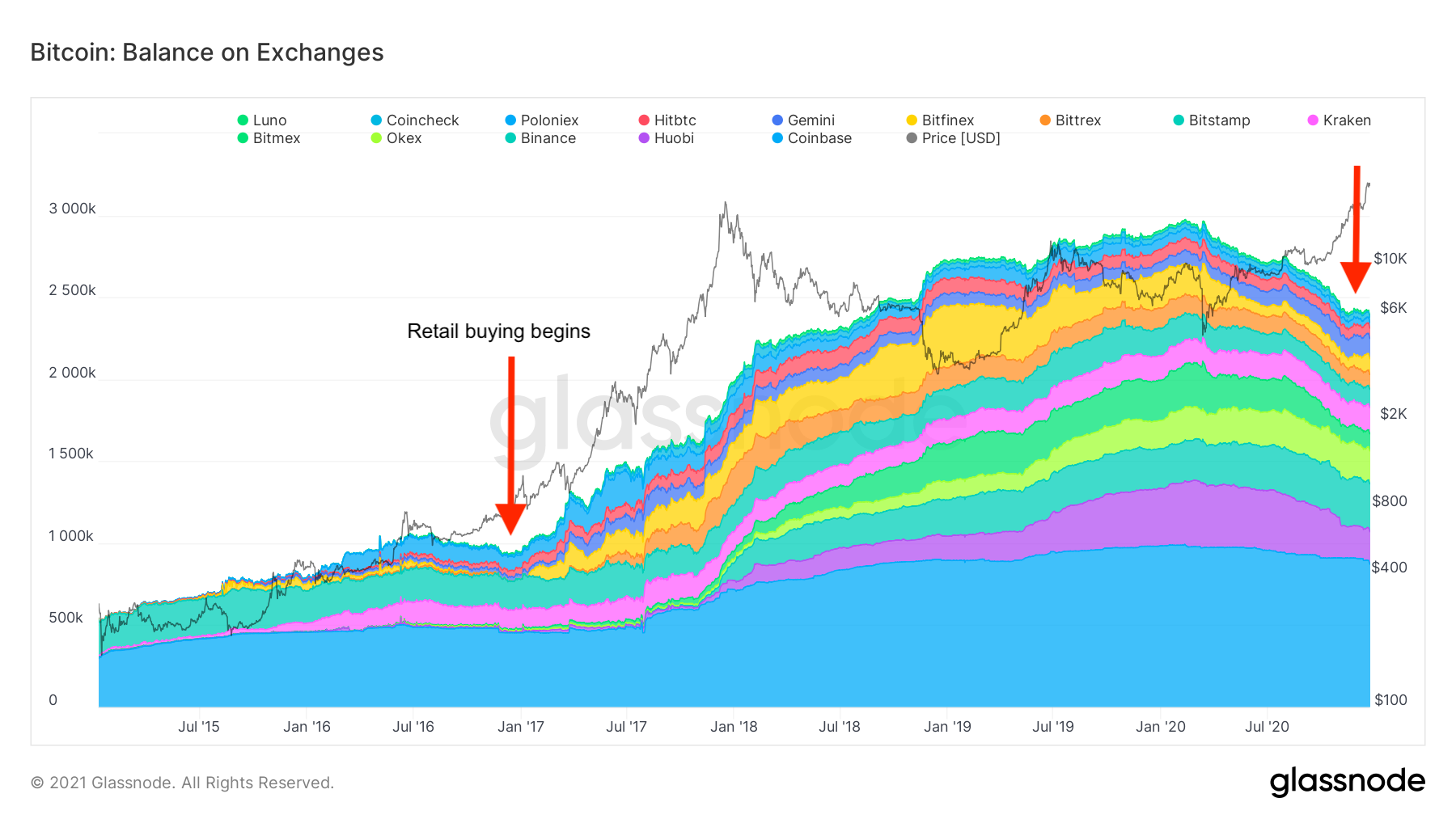

Above is a chart of the Bitcoin balance on exchanges. The two red arrows point to a period when retail buying begins. How do we know that?

Right before the red arrows you can see a downtrend in Bitcoin inventory on exchanges. That signals the accumulation phase of whales and institutions buying and moving their Bitcoin off of exchanges. The red arrows point to a period when it levels off and flattens. That signals the start of retail starting to buy and keeping their Bitcoin on exchanges.

Check out what happens after the first red arrow to the Bitcoin price. It starts to go parabolic while inventory on exchanges also increases significantly. That is retail flooding into the market trying not to miss out. This is the last phase of the bull market that pushes prices to levels we didn’t think possible.

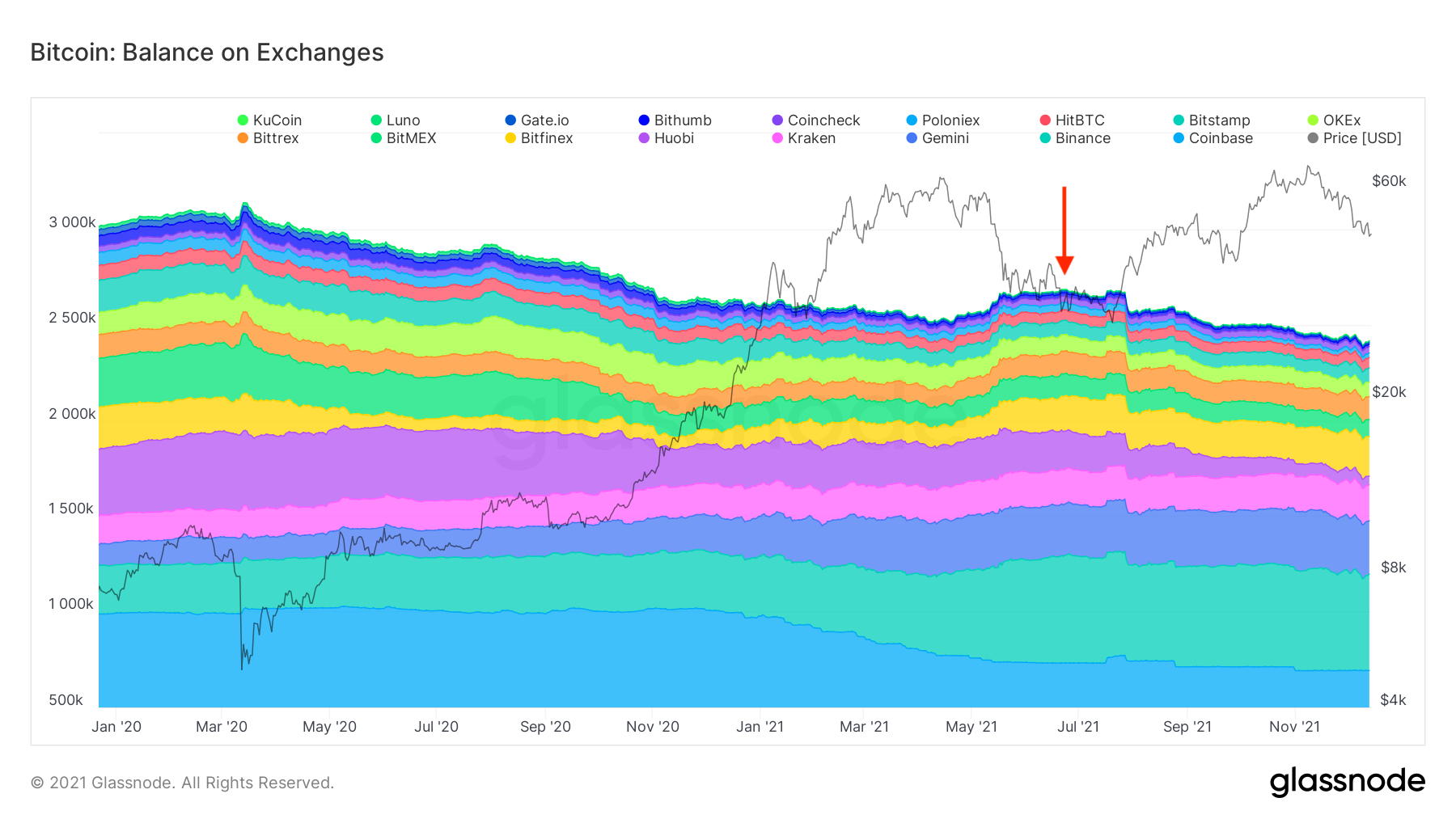

We can also see it happen before our latest pump to $69k.

Following Bitcoin flows is one of the best indicators to recognize on incoming pump or dump for the whole crypto market since altcoins tend to follow Bitcoins latest move.

Bulls on Crypto Street is a trading education website dedicated to digital assets such as Bitcoin, Ethereum, DeFi, NFTs, and other new advancements in the Metaverse.