Stablecoins have been a hot topic as of late, particularly USDT. If you’re not familiar, a stablecoin is a cryptocurrency that pairs to a fiat currency, usually 1:1 or close to it. For example, USDT is meant to act as the USD in the cryptocurrency world. 1 USDT is equal to 1 USD. Stablecoins were created to make it easier for investors all over the world to get in and out of different cryptocurrencies without having to deal with the legacy banking system.

Similar to how the USD acts as a buying vehicle into equities, stablecoins do the same for Bitcoin. As analysts, when we see large amounts of new stablecoins being minted or transferring into exchanges that can signal a price increase in Bitcoin and other cryptos is coming.

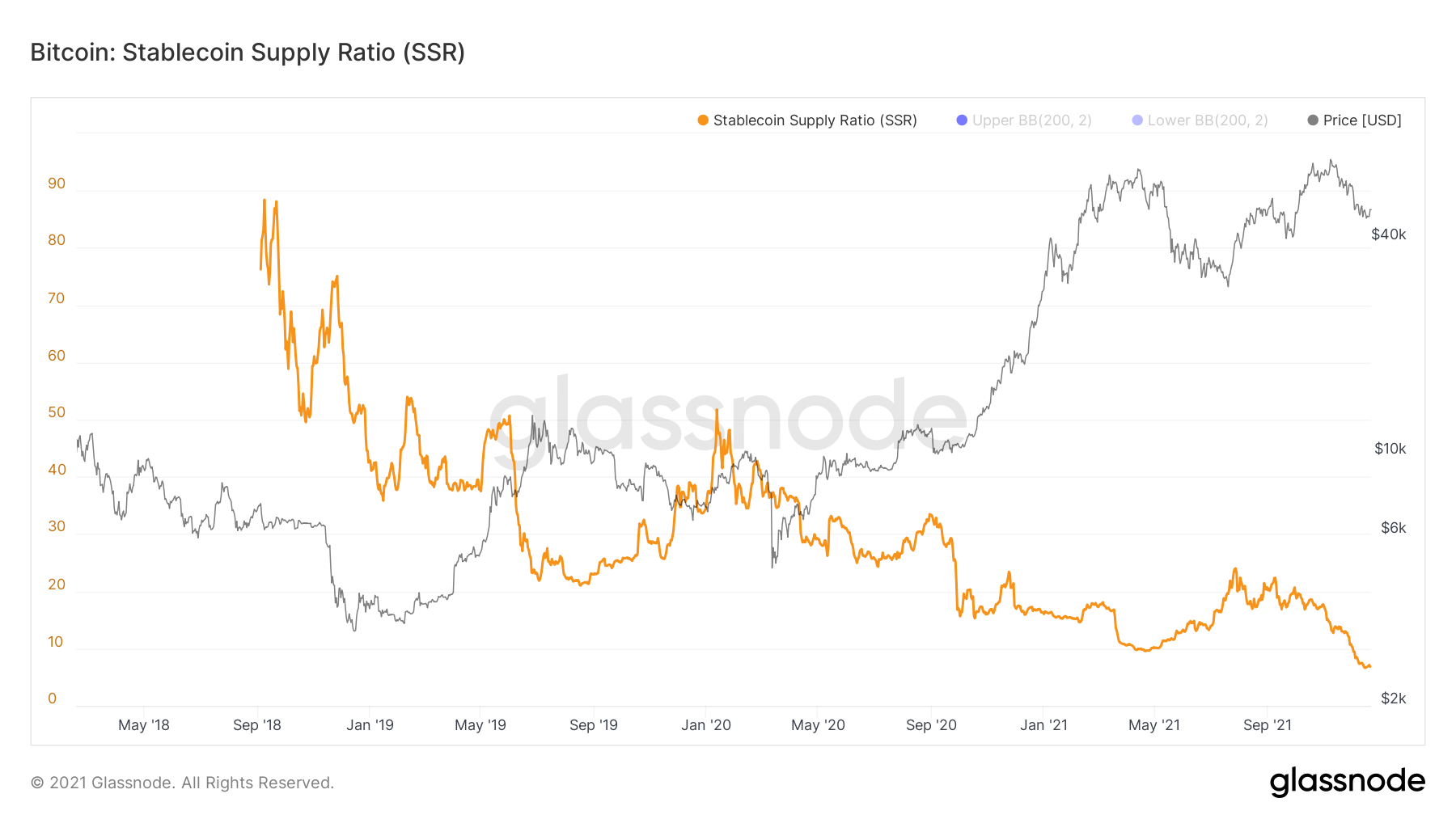

Glassnode has created a metric to help measure the buying power stablecoins have at any current time in the market. They call it Stablecoin Supply Ratio or SSR for short.

What is SSR?

SSR is the total supply of stablecoins denoted in BTC and then compared to the current supply of Bitcoin. As Glassnode says, “the ratio of the Bitcoin supply and the stablecoin supply, denoted in BTC.”

Another way to think of it is Bitcoin Market cap / Stablecoin Market cap.

The following stablecoins are used for the supply: USDT, TUSD, USDC, PAX, GUSD, DAI, SAI, and BUSD. Yes, the stablecoin market has been growing which is why there are many we have to consider. However, currently USDT dominates.

So, if we think about SSR and how it’s calculated then we can use basic logic to determine why it matters. If SSR is low then that means the stablecoin supply is large compared to the Bitcoin supply. The Bitcoin price can also affect this since as the Bitcoin price increases the market cap also increases which gives stablecoins less ability to move the price. As well, total supply of stablecoins can affect this as more stablecoin supply enters the market, the more buying power they have collectively.

Essentially, SSR is one metric to help us analyze the supply/demand dynamics of Bitcoin.

As you can see, from about April 2020 the SSR has been in a lower bound signalling that stablecoins have increased buying power. The Bitcoin price has seen a tremendous uptrend since then.

The SSR started to increase in May 2021 naturally as the Bitcoin price bottomed and has increased substantially. However, since then the SSR has decreased considerably as investors took profits. This aligns with other metrics we have wrote about in previous newsletters that are also signalling the bull market is not over.

It’s important to keep in mind that we cannot rely on one metric only. We look at multiple on-chain metrics as well as other market factors like fiat money supply and real yields.

Bulls on Crypto Street is a trading education website dedicated to digital assets such as Bitcoin, Ethereum, DeFi, NFTs, and other new advancements in the Metaverse.