There have been numerous asset bubbles throughout recent human history. Asset bubbles occur regularly in economies where people get over exuberant over new technological developments. An asset bubble is defined as a period of rapid escalation of asset prices followed by a big decline. It is crucial to understand how these bubbles work, and why the crypto bubble burst this year when it did. Let’s talk about the stages of a bubble, the two most recent asset bubbles, and talk about how these events will indicate the future of Bitcoin and other cryptocurrencies:

5 Stages of An Asset Bubble

Before we talk about the two bubbles since the turn of the millenia, let’s start by identifying the 5 stages of a bubble:

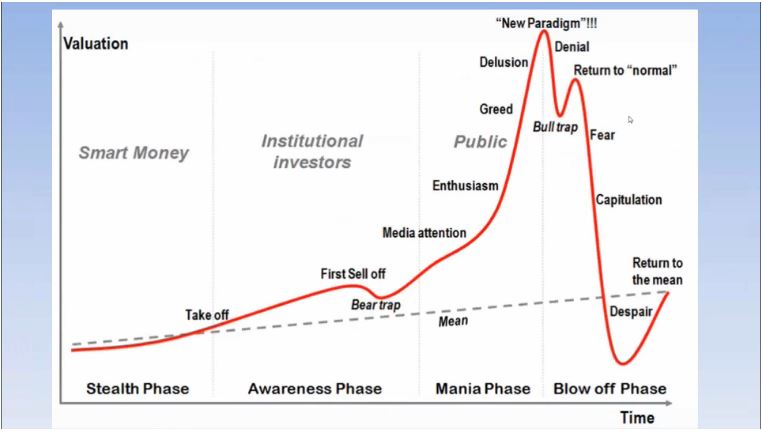

- Displacement: This stage takes place when investors start to notice a new paradigm, like a new product or technology. This stage during the crypto bubble was around January of last year where people were just starting to notice Bitcoin, Litecoin, and Ethereum (trading at under $1000, under $10, and under $30 respectively).

- Boom: This is when prices start to take off. The asset will start to see some strong gains, and catch some attention from the average person. This is the period during the summer of last year when Bitcoin was trading at around $5,000. You could see it being mentioned on more obscure financial news outlets, but it was not quite mainstream yet,

- Euphoria: This period is when assets began to skyrocket in value and start to speed up relative to prior price action. This is where period where the plumber coming to your house is asking you which wallet you use to store your Bitcoin. You will see it all over news outlets. CNBC will be doing pieces like “How to Buy Ripple” when it was trading at over $3 a coin.

- Profit taking: No one knows when a bubble will burst. However during this period you will see some sellers starting to enter the market. We saw this phase during the end 2017 when Bitcoin had the huge 50% crash from around 20k to 10k, but it rebounded strongly after.

- Panic: This is the stage where asset prices crash as quickly as they rose. We saw this stage during January and February of this year. Around this time period people realized that Bitcoin wasn’t heading back to 20k anytime soon. All of a sudden everyone who had bought Bitcoin in the past month were panic selling, causing the price to decline over 50% in a month.

The Dot Com Bubble

The Dot Com began roughly around 1997. The founding of the internet had gotten many investors irrationally bullish on all internet related companies. However eventually reality set in and these stocks came crashing down to Earth. The Nasdaq, which contained many internet based companies that had skyrocketed in value during this period, peaked in early 2000 before coming crashing down.

The Crypto Bubble of 2017

In 2017 we saw some insane moves in the cryptocurrency valuations. Many cryptocurrencies yielded over 1000% returns during this year. However just like the Dot Com bubble, everything eventually fell back down to Earth. This February we saw huge declines in valuations of all the major cryptocurrencies. Most cryptos gave back 70%-80% of their gains from 2017. We have not even seen the market bottom yet, so it cannot be said it is safe to expect cryptos to head back to their 2017 valuations any time soon.

The Future Of Cryptocurrencies

The huge decline in cryptocurrency valuations this year is not something to be pessimistic about. Many great companies like Amazon, Ebay, and Intel during the Dot-Com boom declined massively in valuation during the crash. The period following the crash was not an accurate representation of the price. Many did not realize the potential in these great companies until many years later.

We will see the same thing in the aftermath of the crypto bubble. We are still only 4-5 months past this big contraction in the crypto markets. It took time for people to realize the potential of the great companies that followed the Dot-Com crash. For most of 2001, Amazon was trading under $10 a share (it is trading at around $1600 a share now).

We might see a similar pattern with Bitcoin and other cryptocurrencies. It will take time for them to recover from the crash, and for investors to see more intrinsic value in the cryptocurrency markets. However blockchain technology is so revolutionary that it is just a question of when rather than if it will play a major role in the future of everyday life. Many of the current valuations may be viewed as an opportunity like being able to buy Amazon at $10 a share back in 2001. Rather than trying to pick the market bottom, it may be safer to wait and see which cryptocurrencies survive this huge price decline. There is still a lot of uncertainty to how these markets will be regulated so it will be difficult to see these assets raising in value in the near future until there is more certainty around how governments treat them.

Who Will Win

It’s not a question of whether cryptocurrencies will last. The thing we must decide as investors is which coins or tokens we think will win. Just like how Amazon, Apple, and Microsoft won the Dot-Com bubble, who will win in the cryptocurrency game? The market is evolving everyday and as more regulation comes we must evaluate the best projects that can adapt to changing market conditions.

New to the cryptocurrency trading world? Start here.

Bulls on Crypto Street is a trading education website dedicated to digital assets such as Bitcoin, Ethereum, DeFi, NFTs, and other new advancements in the Metaverse.