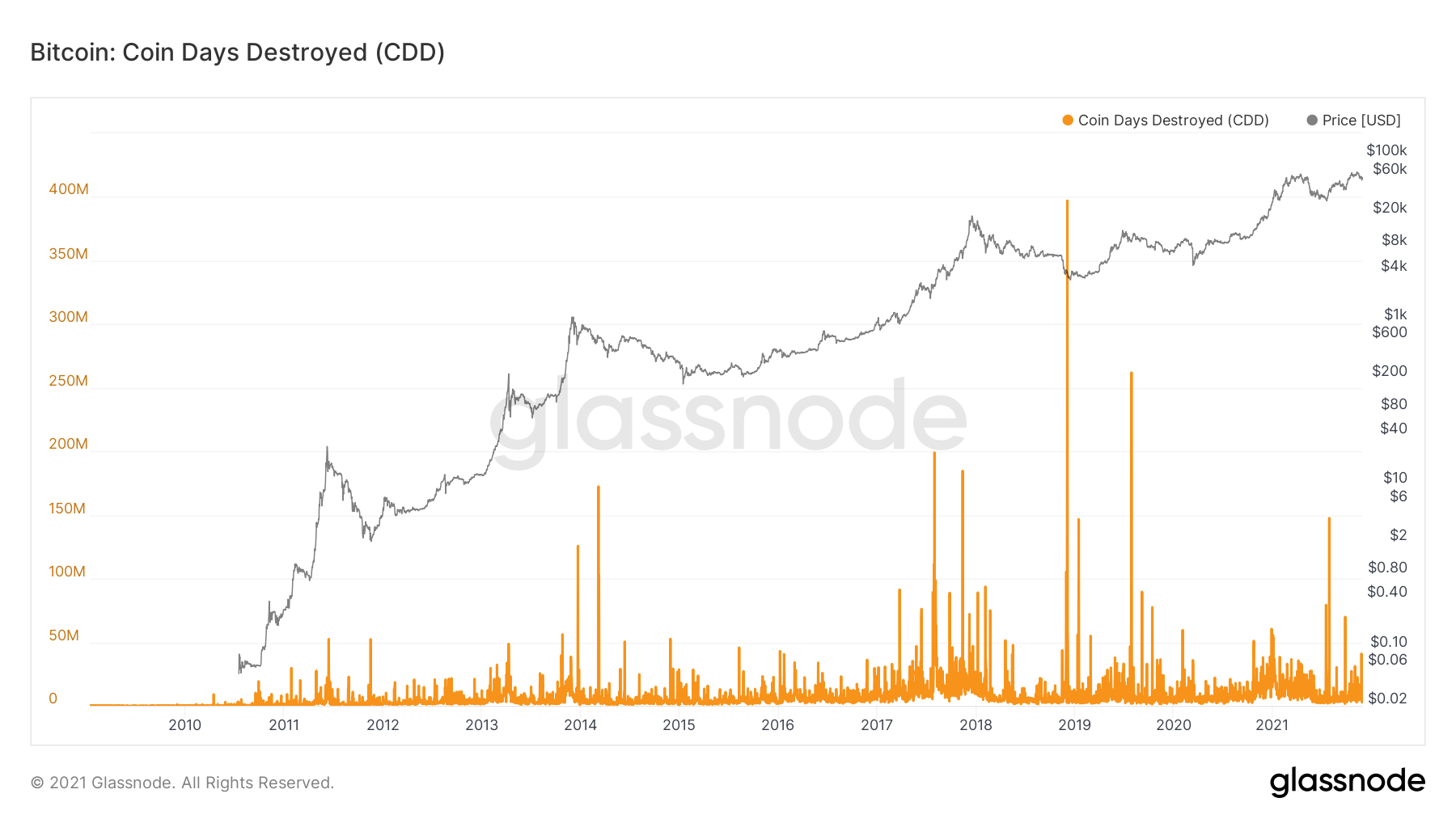

In this previous article, we spoke about HODL Waves and UTXO’s. Expanding on UTXO’s, there is a metric called “Bitcoin Days Destroyed” or BDD for short. BDD is the amount of days erased from a UTXO once that Bitcoin has been moved to another address. Coins that have been in the same address for a long period of time and then moved carry more weight then coins from short-term traders that buy and sell frequently.

For example, one Bitcoin has been in the same address for 100 days. Therefore it currently has 100 Bitcoin days. On the 100th day it is moved to a new address. 100 Bitcoin days have now been destroyed.

Two important factors to consider when analyzing BDD are:

- Exchanges moving large quantities of Bitcoin between wallets for things like technology upgrades or security. This has no significance on demand.

- The circulating supply of Bitcoin is constantly increasing until year 2140.

This means to get an accurate picture of BDD it must be adjusted. Ikigai Senior Quantitative Researcher, Hans Hauge, explains adjusted BDD to VOCD and MVOCD in this must read article.

This brings us to Reserve Risk.

“Reserve Risk is defined as price / HODL Bank. It is used to assess the confidence of long-term holders relative to the price of the native coin at any given point in time. When confidence is high and price is low, there is an attractive risk/reward to invest (Reserve Risk is low). When confidence is low and price is high then risk/reward is unattractive at that time (Reserve Risk is high).”

So what is HODL Bank?

Everyday, Bitcoin holders have the choice to keep their Bitcoin or sell it at the market price at that given time. When they hold, it creates more Bitcoin Days and when they sell, it destroys Bitcoin days. It’s a classic case of opportunity cost; Keep Bitcoin vs take the USD value.

The HODL Bank is the cumulative value of all Bitcoin that has been chosen to hold rather than to sell over the lifetime of the network. This is important because it shows the level confidence in the Bitcoin Network at any given time. If people are choosing to hold then confidence is high and vice versa.

When we compare the HODL Bank to the price at any given time, we get a better idea of the risk/reward of buying, holding, or selling Bitcoin. This is the Reserve Risk.

Luckily for us, Glassnode has us covered so we don’t need to calculate this ourselves.

When Reserve Risk is in the green zone it’s a buy opportunity and when in the red zone it’s a sell warning. You can see that peak Reserve Risk in red zones align perfectly to price tops of that market cycle. Notice we’re currently just above the green zone. What do you think that means?

Bulls on Crypto Street is a trading education website dedicated to digital assets such as Bitcoin, Ethereum, DeFi, NFTs, and other new advancements in the Metaverse.