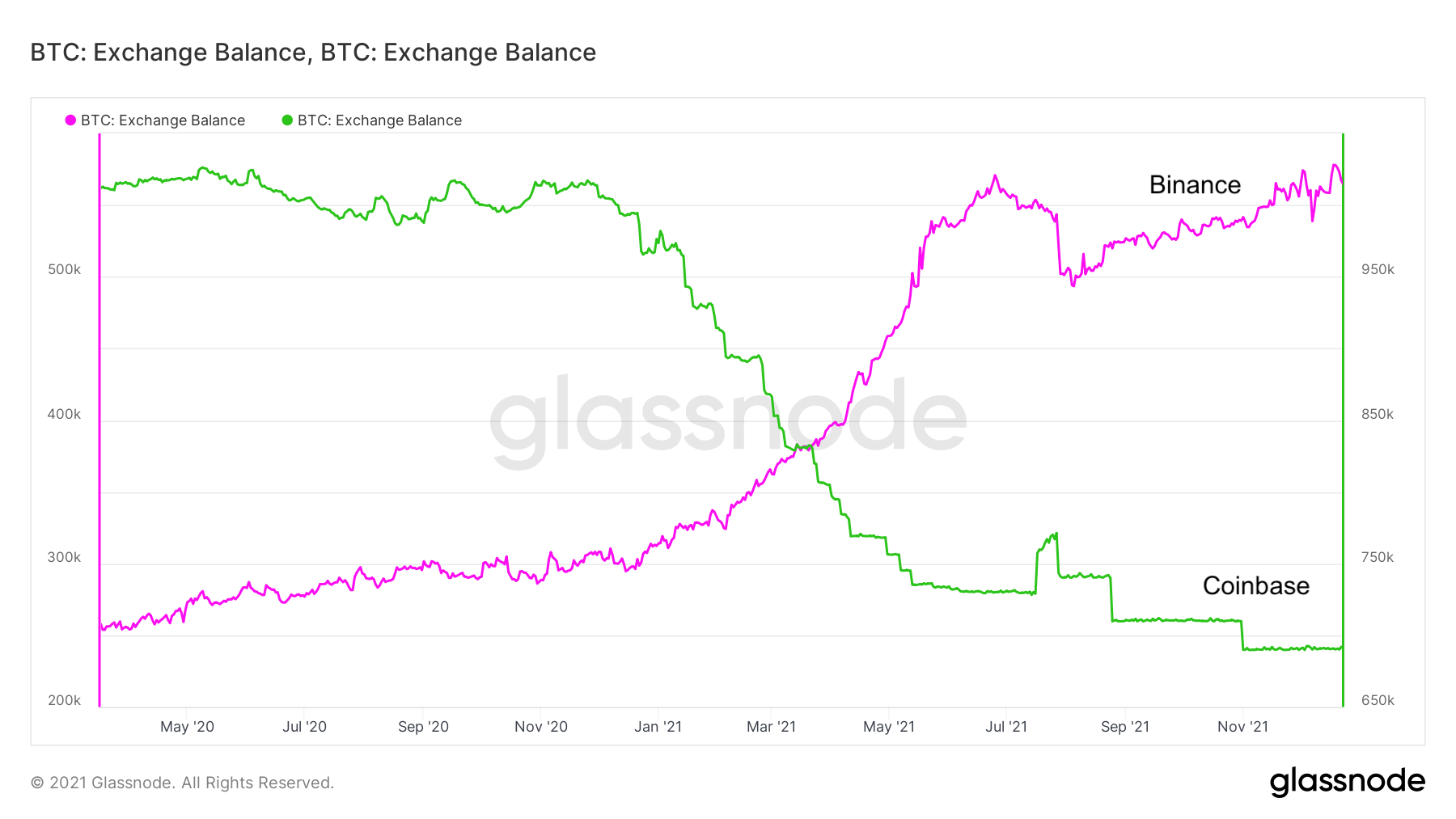

In previous articles we spoke about how short-term holders can take over a larger portion of on-chain activity compared to long-term holders later in cycles. Another metric that showcases this further is the Bitcoin balance held on Binance addresses compared to Coinbase addresses.

Binance is known to be a crypto exchange mainly for retail investors outside of the USA. Coinbase does have retail but also caters too many larger investors or institutions.

What’s interesting is since March of 2020 the balance on Binance has been increasing steadily while the balance on Coinbase has been decreasing.

Coinbase customers include large investors with bigger amounts of Bitcoin that they need to keep off the exchange for security reasons. Since their sums are much bigger than retail, when they move their Bitcoin it creates a bigger impact like a downward trending total balance on Coinbase (as well as total market).

In contrast, Binance has many retail investors with smaller sums that aren’t as concerned about security and traders that need to keep their Bitcoin on the exchange in order to trade.

These factors have created an inverse correlation that helps us analysts get a better idea of the current state of the market when it comes to short-term vs long-term holders.

Bulls on Crypto Street is a trading education website dedicated to digital assets such as Bitcoin, Ethereum, DeFi, NFTs, and other new advancements in the Metaverse.