We have observed a handful of metrics that have been reliable to identify tops and bottoms in Bitcoin Cycles. The Puell Multiple can be added to that list.

Using The Puell Multiple, we can analyze the supply side, Bitcoin issuance. Everyday new Bitcoins are being released onto the network via mining. Those Bitcoins are first awarded to miners. This is the revenue for miners (Bitcoin rewards + transaction fees) and has a big impact on price.

Miners add major sell pressure to the Bitcoin network because they need to constantly be selling Bitcoin in order to pay for their business costs of running a mining operation. These costs include:

- Electricity

- Mining hardware

- Rent and other expenses for the facility

- Other operational expenses

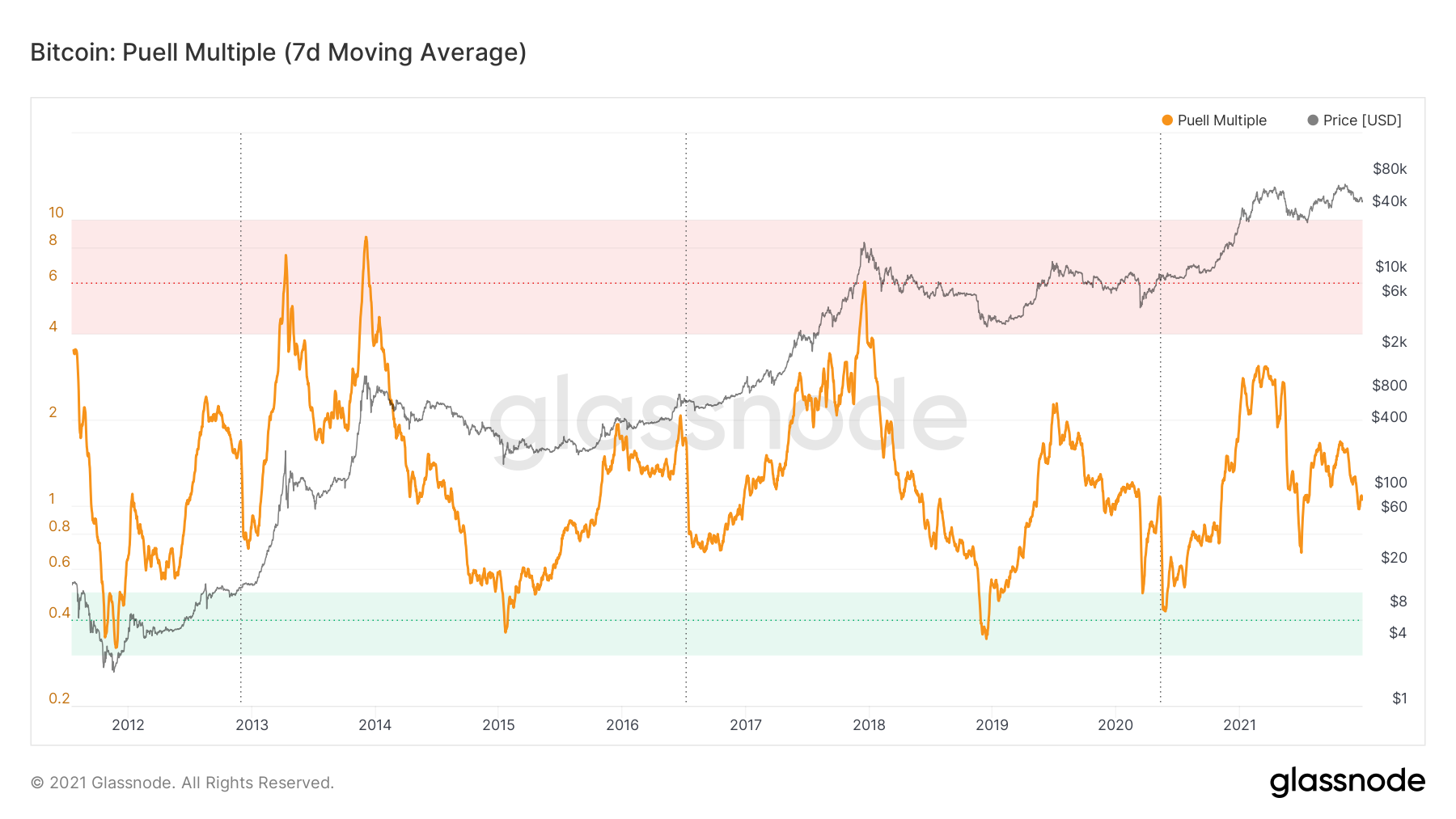

The Puell Multiple is calculated by taking the daily issuance of Bitcoin (in USD) and dividing by the 365-day moving average of daily issuance value (in USD). This analyzes the value of Bitcoins being mined daily compared to longer-term norms. Using this we can identify when new Bitcoins being mined are too high or too low in value relative to the past year.

Periods when The Puell Multiple hit the green zone were times when Bitcoins daily issuance value was low (good buy zone) and the red zone is when Bitcoins daily issuance was considered high (good sell zone) relative to historical norms. The dotted vertical lines are the Bitcoin halvings when Bitcoin rewards for miners get cut in half. The halving is important because the daily issuance is severely impacted after each halving since the amount of Bitcoin being rewarded to miners is cut in half. Therefore transaction fees and price appreciation become increasingly important to miners.

Luckily for us, Glassnode makes tracking this metric very easy. Looks like we still have some ways to go this cycle.

Bulls on Crypto Street is a trading education website dedicated to digital assets such as Bitcoin, Ethereum, DeFi, NFTs, and other new advancements in the Metaverse.