Pi Cycle: Is The Crypto Market Top In?

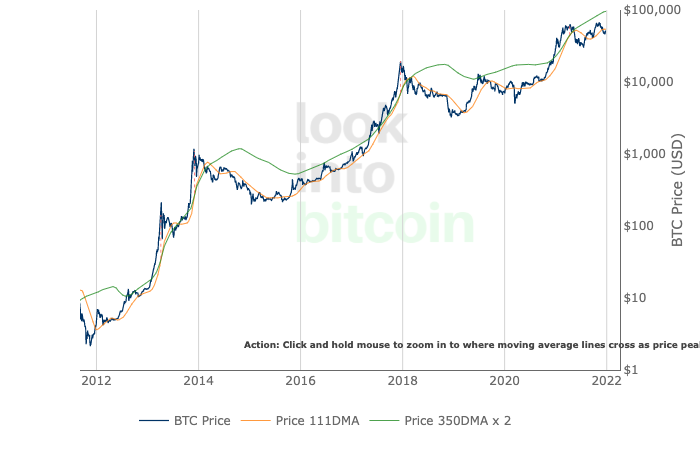

Following up on our last article on MVRV, today we will talk about another top indicator. The Pi Cycle Top Indicator was created by Philip Swift. It’s a very simple indicator to use and has been reliable in picking out market cycle tops within only a few days. The indicator uses an 111 day moving average and … Read more